The billionaire head of Sternwood Capital blames Federal Reserve Chairman Jerome Powell’s interest rate policies for stifling activity in the multifamily sector.

exist Inman Connect Las Vegas, July 30-August. On January 1, 2024, the noise and misinformation will be cut away, all your big questions will be answered, and new business opportunities will be revealed. join us.

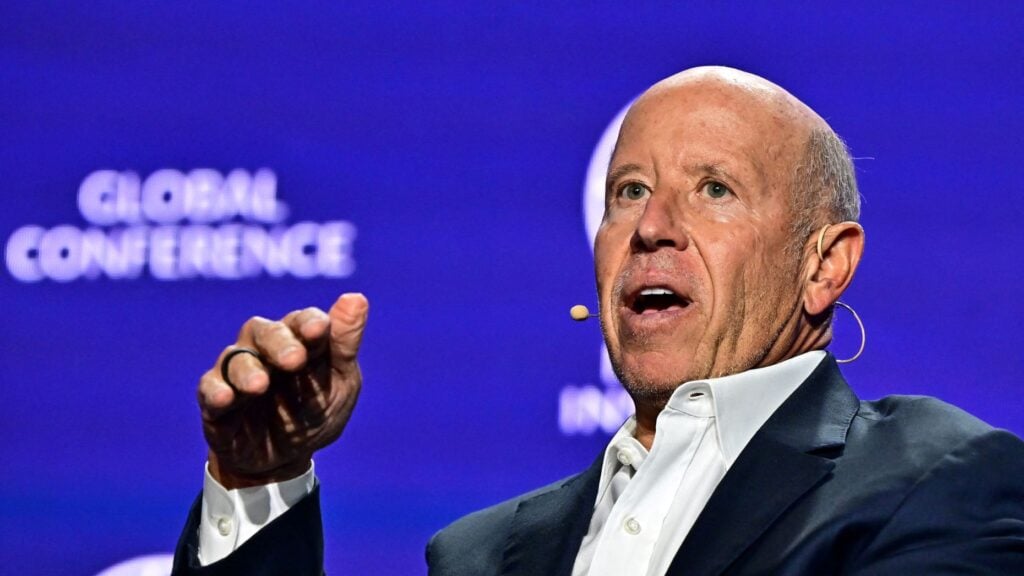

Real estate billionaire Barry Sternlicht believes rents will rise sharply in 2026, and the Federal Reserve is to blame.

In an interview with CNBC, the CEO and chairman of Sternwood Capital blamed Fed Chairman Jerome Powell’s rate action for killing activity in the multifamily sector, which he believes will ultimately Leading to a sharp decline in available apartments and a spike in rents.

“Here’s my problem with Powell: His policies have now crushed multifamily housing starts. We need houses,” Sternlicht said. “Only 220,000 houses are occupied [2026]I guarantee you, barring a massive recession, rents will go up in ’26.

Rent rates have been largely stagnant nationwide, but have fallen significantly in Sun Belt markets that have experienced a post-pandemic construction boom, according to Redfin data.

“The Sunbelt has built a ton of new apartments in recent years, in part to meet a surge in demand from people moving in during the pandemic housing boom. But the boom is over and now owners are struggling to fill vacancies, which has led to lower rents,” Redfin senior Economist Sheharyar Bokhari said last month.

“The good news is that increased housing supply in the Subert area has improved affordability for renters, which could be a lesson for other U.S. cities dealing with housing affordability challenges.”

Sternlicht said in an interview that as in other tense times, the housing market is experiencing a growing disconnect between buyers and sellers, with buyers seeking the cheapest prices and sellers looking for prices they could have obtained a year ago. But he noted that the gap is closing, which means the market may be heading in a healthier direction.

“Spreads are emerging, which means the market is healing – the future is becoming clearer, especially for apartments,” Sternlicht said.

Email Ben Vader