this federal housing administration (FHA) this week announced a proposed mortgagee letter (ML) that would add fraud and misrepresentation to the list of deficiencies in Federal Housing Administration (FHA) Title II-funded mortgage financing.

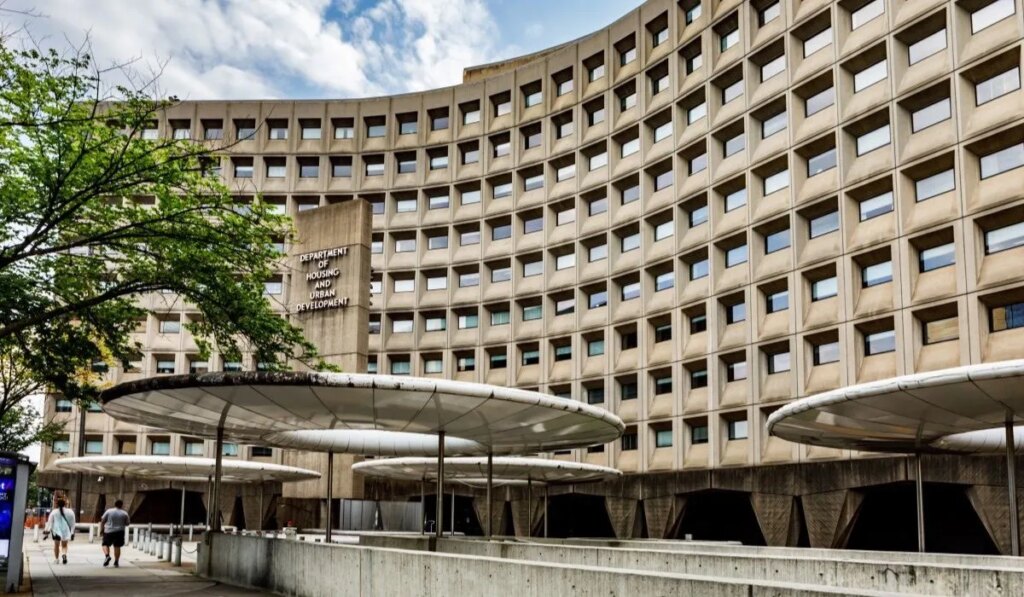

The Deficiency Taxonomy consists of a list of attributes that the Federal Housing Administration (FHA) uses to identify potential deficiencies in loan grades as required by government policy. U.S. Department of Housing and Urban Development (heads-up display). The FHA explained that the new proposed ML would add fraud or misrepresentation involving a third-party originator as a “first-level serious defect” because lenders are responsible for the actions of their sponsored third-party originator (TPO) partners.

Level 1 means the lender “knew or should have known” about the defect. Currently, fraud or misrepresentation in a TPO under a Chapter 2 loan may fall under Level 1 or Level 4, the latter meaning that the lender “did not know and could not have known” of the defect.

“FHA proposes these changes to better align the deficiency taxonomy with these existing requirements and to reduce risk to the Mutual Mortgage Insurance Fund (MMI Fund),” the FHA stated. “The provisions of the draft ML apply to all FHA Title II Single-Family Mortgage Programs,” these programs primarily serve low- and moderate-income borrowers.

“Under this update, FHA will seek loan terms from mortgagors when there is evidence of fraud or material misrepresentation by a sponsored TPO, regardless of whether FHA identified specific red flags that should have been challenged at the time of underwriting,” the draft reads. compensation.

The draft ML is available through FHA’s Single Family Drafting Form, an online portal that allows stakeholders to review proposed policies before implementation. You can provide feedback to FHA by June 24 using a dedicated response worksheet, which is also available online.