Thorston Asmus

J.P. Morgan’s Global Markets Strategy team notes that short interest on the SPDR S&P 500 ETF Trust (New York Stock Exchange: Spy) and Invesco QQQ Trust ETF (NASDAQ: QQ) has fallen to all-time lows but warned the decline could be reversed Impact on U.S. stocks.

SPY tracks Wall Street’s benchmark S&P 500 (SP500) index, while QQQ tracks the tech-heavy Nasdaq 100 (NDX). Both exchange-traded funds (ETFs) are very popular with investors, with the former being the oldest fund in the United States and the latter being launched in 1999.

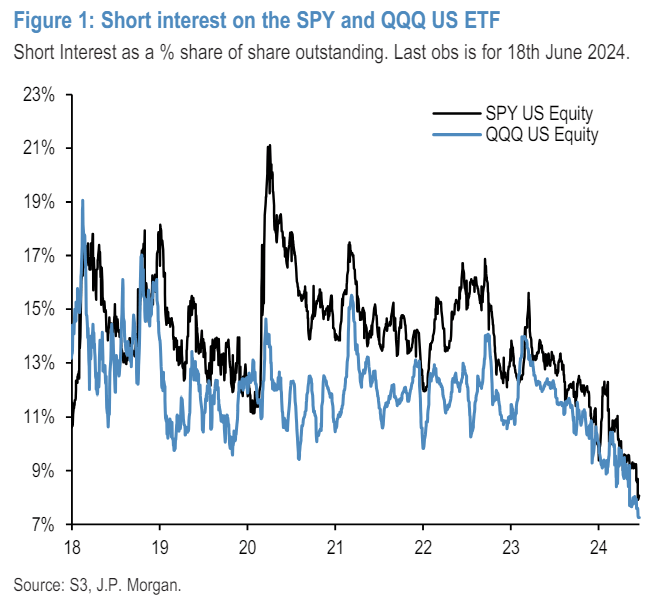

Declining short interest in the two major equity ETFs has been a key support for U.S. stocks since the second quarter of 2023, JPMorgan said. The chart below highlights short interest information since 2018:

According to data provided to Seeking Alpha by S3 Partners, QQQ’s short interest as a percentage of float was 16.61% in 2018. is 17.67%.

In comparison, during the same time period from 2018 to 2023, QQQ’s Soared 163.05% spies have Soared 78.11%.

JPMorgan’s Nikolaos Panigirtzoglou said in a research note: “SPY and QQQ are the main tools for investors to open positions in U.S. stocks at the index level. As short positions are gradually covered, their declining short interest provides a good opportunity for U.S. stock indexes.” Stable flow support.

“In other words, the decline in short interest in these two major ETFs over the past year has amounted to a hidden short volatility trade. Considering how low their short interest currently is, this hidden short volatility trade looks quite long-term. At one point, historical standards pose a vulnerability to U.S. equities, with negative news starting to reverse the decline in short interest over the past year,” Panigirzoglu added.

The analyst and his Global Markets Strategy team estimate end-of-quarter equity rebalancing flows to be around $50B.