Dmitry Vinogradov

Societe Generale believes the S&P 500 is at a “pivotal juncture” and outlined two scenarios in which the Wall Street benchmark could fall to 4,000 points or surge into “bubble” territory above 6,600 points.

S&P (SP500) has More than 14% advanced Year-to-date, the continued craze for artificial intelligence (AI) has driven sharp gains in technology stocks and expectations that the Federal Reserve will begin cutting interest rates if inflation data remains as optimistic as it has been recently.

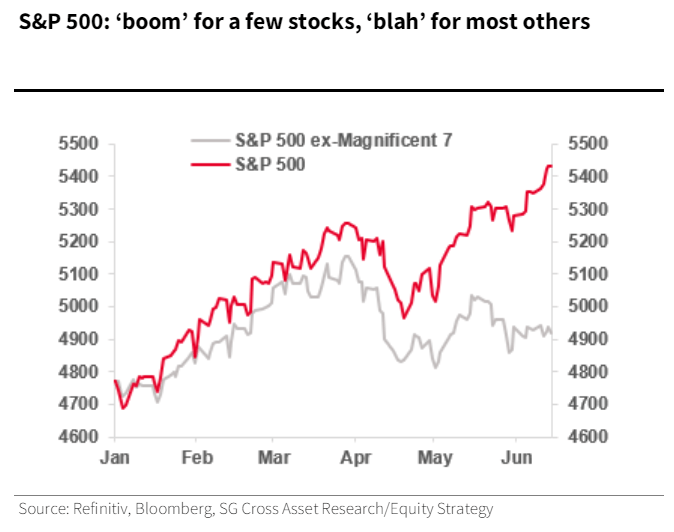

However, a growing concern among investors in this relentless bull market is market breadth – the S&P (SP500)’s 2024 gains are largely due to big gains in the “Magnificent 7” club, while the S&P stock average Hard to keep up.

“In fact, without the ‘Magnificent 7’ (Mag-7) stocks, the S&P would only be up 4%. Nvidia (NVDA) alone is up 174% year to date; it is the index’s top performer, With the largest market capitalization, the stock accounts for 40% of the S&P 500’s total gain this year,” Societe Generale’s Manish Kabra and Charles de Boissezon said in a research note on Monday.

“To illustrate the point, the equal-weighted S&P 500 (RSP) rose just 4%, significantly underperforming the U.S. benchmark,” they added.

Analysts believe that the performance of large-cap technology stocks relative to the S&P stock average is now at a “critical juncture.”

See the chart below comparing the performance of the S&P 500 with and without the “Magnificent 7” club:

According to Société Générale, this narrow market width typically occurs during a bear market phenomenon common in recessions, or when a concentration of outperforming companies threatens to push the market into bubble territory.

“What if there’s a recession? We don’t think investors will enter into a recession trade unless the Fed starts raising rates again, and that’s far from our base case. However, if small business profits take a serious hit, With unemployment exceeding >=5%, we could see the S&P 500 fall back to around 4,000 – a low-probability event at this stage,” Kabra and de Boissezon said.

“What if there’s a bubble? On the other hand, if the S&P 500 accelerates further, only a few stocks rerate more significantly than others, and the index’s valuation levels are at par with what’s happening since the S&P 500 is in Peaking in 1999-2000, we think the S&P 500 could rise to 6,666 (24.7x March 2000 x 2025 S&P 500 EPS of $270),” the analysts added.

The brokerage kept its year-end target for the Wall Street benchmark unchanged at 5,500. The S&P (SP500) surpassed this historic milestone last week on June 20, closing Tuesday’s session at 5,469.30.

“We like technology stocks and remain overweight. However, as the profit cycle for companies outside of Nasdaq 100 (NDX) companies should increase from -10% in 2023 to +8% in 2024, we also find that technology cyclical opportunities beyond stocks.