Pictures of Jet City

Tesla (NASDAQ: Tesla) is expected to show a decline in quarterly deliveries when it releases its second-quarter update in the first few days of July. The delivery report will be released weeks before the company releases its full second-quarter earnings. Report.

Analysts have been adjusting their estimates for Tesla (TSLA) deliveries due to concerns about consumer demand and registration data in Europe and China. Barclays lowered its delivery forecast to 415,000 vehicles, an 11% annual decrease. RBC Capital Markets lowered its forecast to 410,000 vehicles in the second quarter after forecasting 533,000 vehicles a few months ago. Meanwhile, UBS Group AG puts its delivery forecast at 420,000 vehicles. By comparison, Tesla (TSLA) delivered 386,810 vehicles in the first quarter and 466,140 vehicles in the second quarter last year. Tesla’s (TSLA) quarterly peak delivery volume was in the fourth quarter of 2023, with 484,507 vehicles delivered.

Some analysts believe the second-quarter delivery report will be free of the usual drama, as the company plans to host a high-profile Robotaxi event later in the summer. Analyst Ben Kallo noted: “In contrast to Q1 2012, when investor attention was primarily focused on lofty near-term delivery expectations, we are seeing more investors shift their views towards the August 8 Robotaxi activity and FSD-related opportunities. He expects investor attention will remain skewed toward the longer term ahead of the Robotaxi unveiling, which could include details on a low-cost, next-generation vehicle for the masses, Wedbush Securities analyst Dan Ives expects. There will not be any major events in the second quarter. Instead, he believes that the seeds of a demand improvement have begun to emerge, which means that Musk and Tesla now need to carry out tasks in the second half of the year and beyond. For its part, UBS is more skeptical about the Robotaxi incident. Whether Tesla ( TSLA ) has made good technological progress with its Robotaxi and Optimus programs and is more likely than most companies to leverage artificial intelligence for real-world performance is something the company believes could drive the stock higher immediately. These developments are seen as further positive for the financial model. Elsewhere, Susquehanna sees some tailwinds for Tesla (TSLA) that make it a good time to buy long call options. The firm’s derivatives strategists noted that the stock’s volatility has declined, seasonal trading patterns look promising, and the stock has been underperforming the majority of the S&P 500, which is further favored by retail investors. established its status.

In Seeking Alpha, analysts remain more cautious than their Wall Street peers. For one, Dividend Sensei recently highlighted six reasons why TSLA’s robotaxi dream might fail.

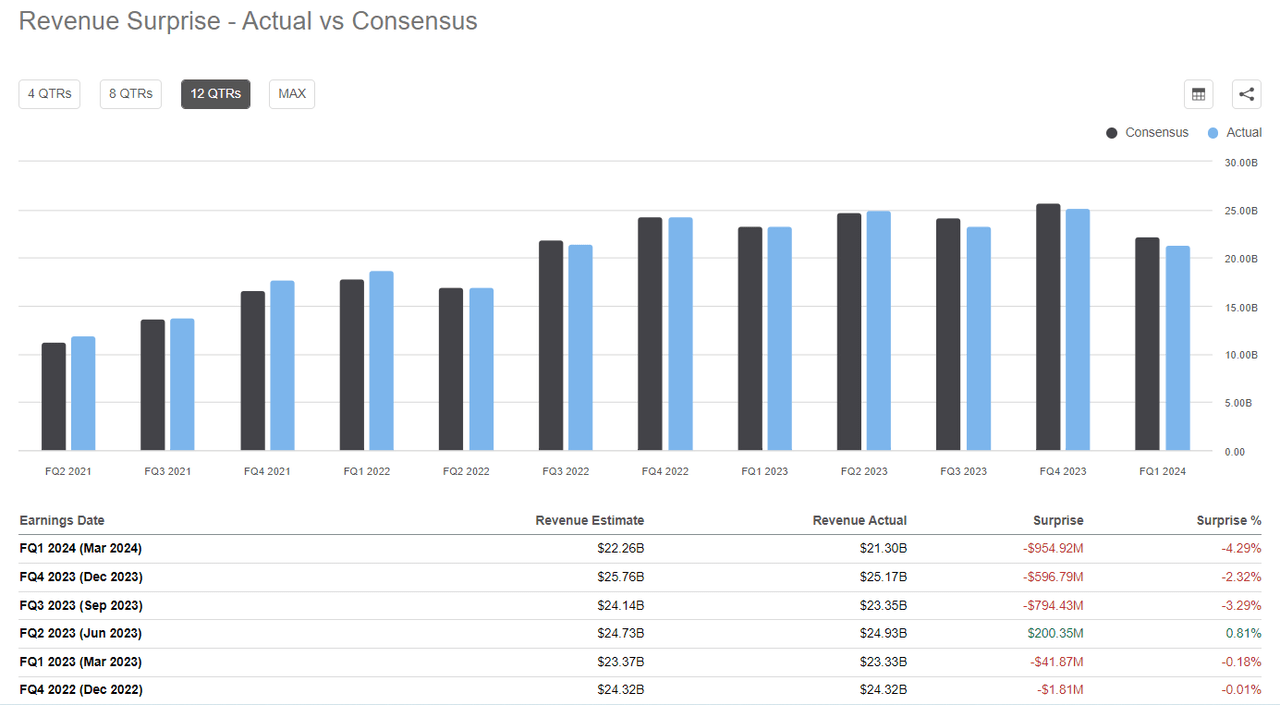

Ahead of the big robo-taxi event, the electric vehicle giant also has to report second-quarter earnings. The report will once again focus on automotive gross profit margins. It’s worth noting that Tesla’s (TSLA) recent track record is that its quarterly results have missed consensus more often than they have beaten estimates. Tesla shares fell in a week after reporting earnings in three of the past four quarters.