primeimages/E+ via Getty Images

As the S&P 500 (SP500) (SPY) continues to hit all-time highs in 2024, market breadth will shrink.

On Tuesday, the large-cap index edged up about 0.1% to 5,576.98 points, setting a new closing high for the 36th time this year. The index is up 17% so far this year, and exist Wednesdaywhich is heading for its seventh consecutive victory.

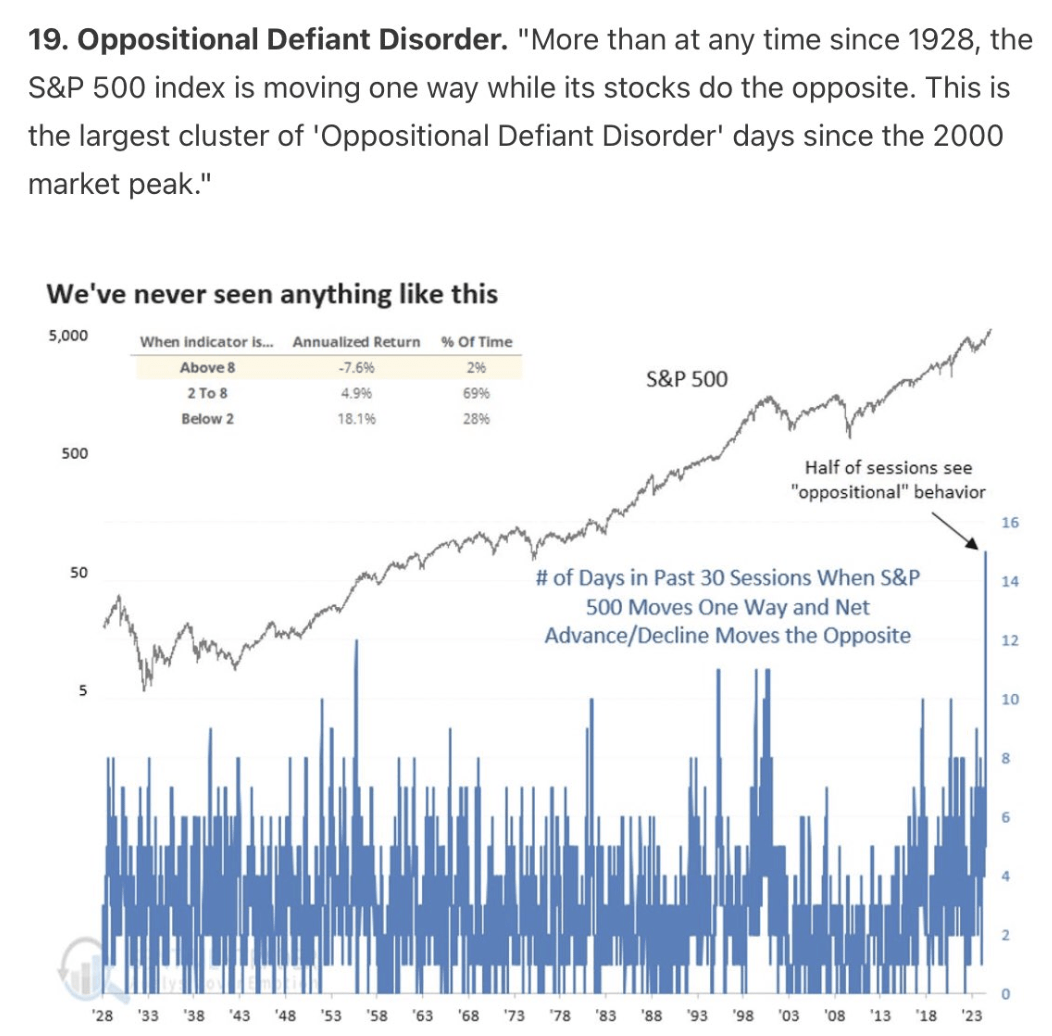

But since 1928, the S&P 500 (SP500) has “moved in one direction, while its stocks have moved in the opposite direction,” according to a chart from investment research firm SentimentTrader. Albert Edwards, global strategist at Société Générale, credited SentimenTrader founder and chief research analyst Jason Goepfert with the chart in X News on Wednesday.

“Oppositional Defiant Disorder” is how SentimentTrader describes what’s happening behind the S&P 500 Index (SP500) (VOO). Its chart highlights that the S&P 500 has moved one way on 14 of the last 30 days, while Net Advances/Decline (a market breadth indicator) has moved in the opposite direction. Here is the chart:

So far this year, about 40% of the 503 S&P 500 stocks have fallen.

Edwards said in his

This year’s winners included big tech stocks including Nvidia (NVDA), which surged 171%. Microsoft (MSFT), the index’s top weight, is up 22% year to date.

ETFs that track the S&P 500 include (IVV), (SSO) and (SPXU).