Nvidia H100 chips remain the hottest commodity in the tech industry, but unfortunately the same cannot be said for its stock.

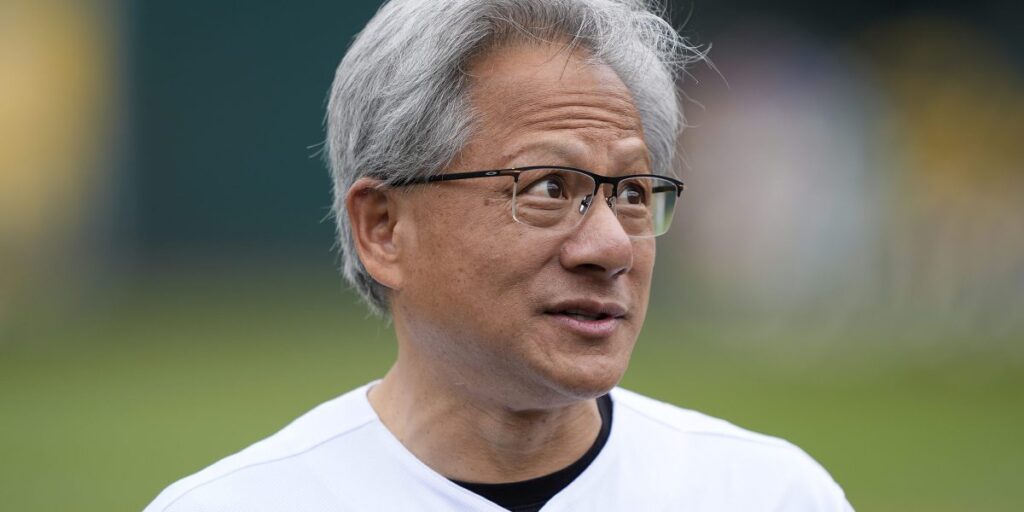

Shares of Jensen Huang’s semiconductor company have plunged 20% since hitting a record closing high on June 18, generally considered the beginning of a bear market. More than $780 billion has been wiped off its market value, equivalent to the entire value of Elon Musk’s Tesla or Eli Lilly, the company behind the GLP-1 weight loss drug Mounjaro pharmaceutical group.

While the stock staged a mitigating rally Wednesday, moving sharply higher, it only rebounded to last week’s levels, and the gains are likely to be short-lived as sentiment across the industry remains fragile.

Futurum Group, an industry research and advisory firm for the technology industry, said Financial Times This weakness is likely simply a rotation of sectors that have performed well during the year, rather than anything related to their fundamentals.

“We’ve seen money flow out of big tech companies, I think primarily because they’ve experienced incredible growth, which certainly provides room for some selling,” Chief Executive Daniel Newman said.

Nvidia sells graphics processors that are best suited for training neural networks, such as OpenAI’s GPT-4 and the Transformer used in other large language model development. Its most advanced chips are so powerful that the United States has implemented export controls to ensure they don’t fall into the hands of strategic rivals like China.

However, concerns have grown in recent weeks that major cloud computing providers (including hyperscalers Amazon, Microsoft and Google) and other large companies investing heavily in artificial intelligence (such as Meta and Tesla) may not be able to obtain enough return on investment.

Microsoft expects revenue growth at its Azure cloud business to slow in the current first quarter, after growing 29% in the three months to June, before accelerating in the second half of the fiscal year. Shares took a big hit Wednesday, lagging the S&P 500’s gains badly.

“Kicked to the curb”

Another major customer that Nvidia has disappointed recently is Tesla, which needs artificial intelligence training chips to solve self-driving problems – a problem that CEO Musk has promised he will finally solve this year or next. (He has previously promised that Tesla cars will be able to drive off-road on their own by the end of 2017.) So far this year, he has spent $1.6 billion to expand his computing cluster, which uses data from cameras installed on all cars. images for training.

On an investor call last week, Musk said the lack of consistent and reliable supply of Nvidia H100 chips has forced him to now double down on investment in Dojo, his own proprietary chip optimized for vision-based machine learning. Musk has talked about leasing backup training computing to third parties, and Morgan Stanley estimates that this “Dojo as a service” could be worth hundreds of billions of dollars. If successful, his custom chips could pose a threat to Nvidia.

Even after the decline, Nvidia shares have more than doubled since early January. But it’s a far cry from the heady days this spring, when it surpassed Apple and Microsoft to become the world’s largest company, with a market value of more than $3.3 trillion at one point.

The weakness has also affected its Taiwanese production partner TSMC, the world’s largest microchip foundry that outsources manufacturing to third parties such as Nvidia. Its shares have lost about $200 billion in the past few weeks after once topping the $1 trillion mark. It’s also experiencing a mitigating rebound.

“Nvidia stock has become a wasteland,” said investor and host Jim Cramer. CNBCof I’m crazy about money Tuesday. “That’s because Nvidia didn’t benefit from the rate cuts, so its stock price took a hit in this environment.”

Nvidia did not respond to a request for comment. wealth.

Later on Wednesday, the Federal Reserve was expected to lay the groundwork for a rate cut in September, the first since March 2020.