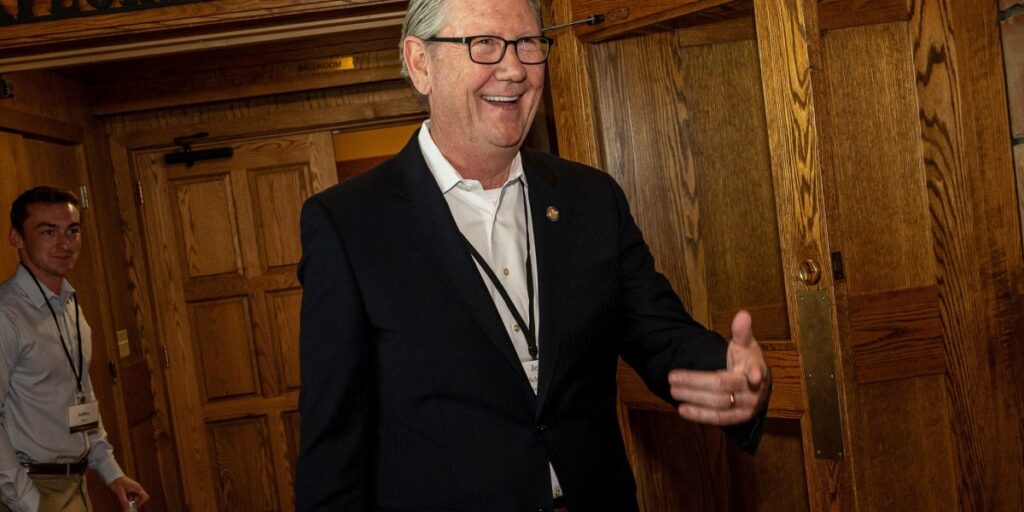

Kansas City Fed President Jeffrey Schmid said he is not prepared to support a rate cut because inflation is above target and the labor market remains healthy despite cooling.

In a speech to the Kansas Bankers Association, Schmid said the recent decline in inflation was “encouraging” and that further reports of low price pressures would bolster his confidence that inflation is heading toward the central bank’s 2% target. interest rate.

“We’re close, but not quite there yet,” Schmid said. He did not comment on when the Fed would cut interest rates: “The policy path will be determined by data and economic strength.”

Fed policymakers resisted calls for drastic action after a weaker-than-expected jobs report in July, when hiring slowed markedly and the unemployment rate rose to its highest level in nearly three years. The market is highly likely to cut interest rates by half a percentage point in September.

“Overall, the labor market still looks healthy,” Schmid said. “Last week’s July jobs report left many questioning that resilience. But it’s worth noting that many other indicators point to continued strength.

“The overall tone of business in the Kansas City Fed district is upbeat and resilient,” he added.

Policymakers last week kept interest rates unchanged at their highest level in more than two decades but signaled they were closer to lowering borrowing costs. Chairman Powell said the central bank could cut interest rates as soon as possible at its September meeting.

Schmid, one of the more hawkish Fed officials, said inflation soared to multi-decade highs two years ago and progress needed to be carefully assessed. “We should be looking for the worst data, not the worst,” he said. Good data.

Schmid was named president of the Kansas City Federal Reserve Bank last August. The former dean and CEO of the Southwest Bank Foundation Graduate School at Southern Methodist University’s Cox School of Business is a longtime banker and bank regulator.