Middle East and North Africa-focused music streaming service Anghami reports 18% annual increase The number of paid subscribers increased in the first quarter of 2024.

Meanwhile, its 2023 annual report showed that its operating losses narrowed despite “headwinds” from the war in Gaza and lower revenue due to the depreciation of the Egyptian pound.

The number of premium subscribers reaches 1.87 million As of March 31, the end of the first quarter, the Nasdaq-listed company said in a statement released on Tuesday (April 30).

Angami reported 8% annual increase The increase in revenue for the quarter was primarily due to 27% Subscription revenue grew significantly this quarter.This helps narrow its operating losses $5.4 million arrive $2.7 million“reflects progress in profitability.”

Its quarterly gross profit margin improved to 26%from 20% a year ago.

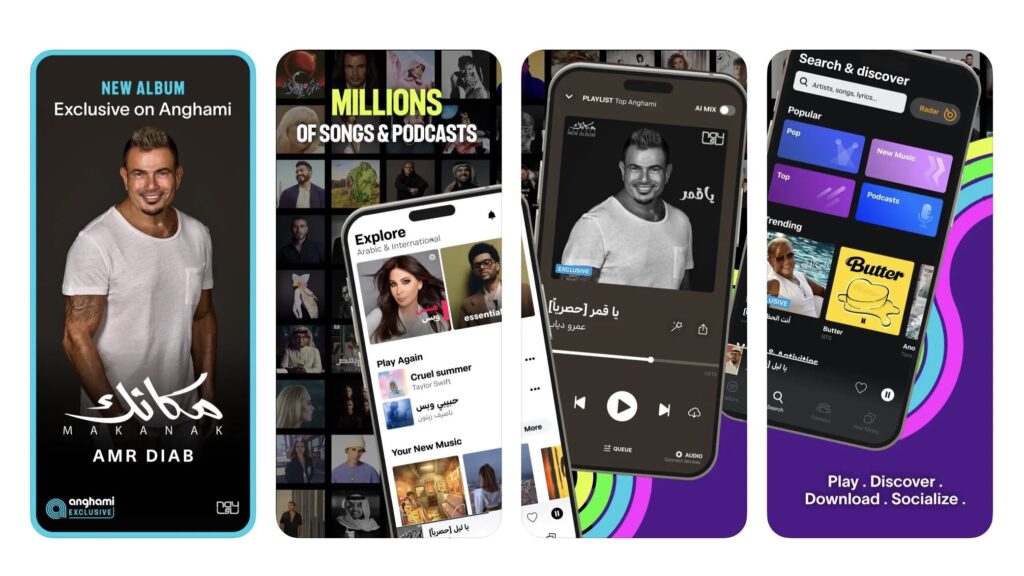

The company noted that it “completed several key strategic transactions” during the quarter, including “an investment in Saudi media leader SRMG, a rotana musicand expanded with [Egyptian singer] Amr Diab (Including four concerts in major cities in the MENA region).

First-quarter results showed Anghami is heading through a tumultuous 2023, with revenue falling sharply, offset by higher gross margins as a result of lower costs.

Anghami demonstrated in its annual report to the U.S. Securities and Exchange Commission (SEC) Annual increase of 14.6% Total revenue fell, US$41.38 million.

Nonetheless, the company’s operating loss narrowed to $14.56 millioncompared to $17.38 million 2022. US$39.13 million by 2022 US$31.09 million 2023.

The company’s gross profit margin for the year rose to 24.9% from 19.3%.

The company breaks down revenue into three segments: premium (subscription), ad-supported and live events.

Premium’s revenue is US$24.56 millionaccounting for approximately 59% of the total, and dropped Annual increase of 9.3%.

Ad-supported revenue is $9.9 milliondown 17.9% This year, live events brought $6.92 milliondown 26.1%.

“Anghami’s financial performance in 2023 was directly affected by the depreciation of the Egyptian currency. This was partially offset by strong growth in premium users in Egypt, a key market in the MENA region.

“In addition, the war in Gaza severely disrupted advertising and live events in the fourth quarter of 2023, resulting in the postponement of multiple key projects and events into 2024.”

Egypt is Anghami’s third-largest market in terms of revenue, after the United Arab Emirates and Saudi Arabia.

The company also reported 27% annual increase Premium average revenue per user (ARPU) fell to $1.53 from $2.09 a year ago.

The company attributes this to currency depreciation in Egypt and Lebanon, “as well as the launch of new pricing plans. Notably, offerings such as Arabic-only plans for countries with traditionally lower ARPU, such as Egypt, contributed to this change.

Anghami added, “Subscriber numbers continue to grow across our core subscription businesses, supported by our rapidly growing advertising and production segments, which overcame multiple challenges and headwinds to deliver impressive results in 2023.

“We expect OSN+ post-transaction revenue to grow significantly.”

Eli Habib, Angami

Last fall, Anghami was warned by Nasdaq that it was at risk of being delisted due to its low share price, which was hovering around 1.

A few weeks later, the company announced OSN Group, owner of TV and movie streaming services focused on the Middle East and North Africa region. OSN+will acquire a majority stake in Anghami. The transaction values Anghami at $3.69 The two companies said the merger would create an “entertainment giant” in the region.

As part of the merger, OSN will hand over its streaming services and brands to Anghami and pay $38 million According to the annual report, the company will purchase 36.99 million Anghami shares. OSN Group currently holds 55% Angami’s shares.

Anghami shares tripled on the news, peaking at $3.11but has since fallen back, and the transaction price is $1.10 arrive $1.30 In recent weeks, the company has emerged from the Nasdaq delisting danger zone.

The first-quarter numbers do not reflect the merger, which was completed shortly after the end of the quarter.

“2023 is a transformative year for Anghami. We are repositioning our business to improve margins and profitability and expand our services in the region. We expect OSN+ post-transaction revenue to grow significantly. Eli Habibco-founder and CEO of Anghami.global music business