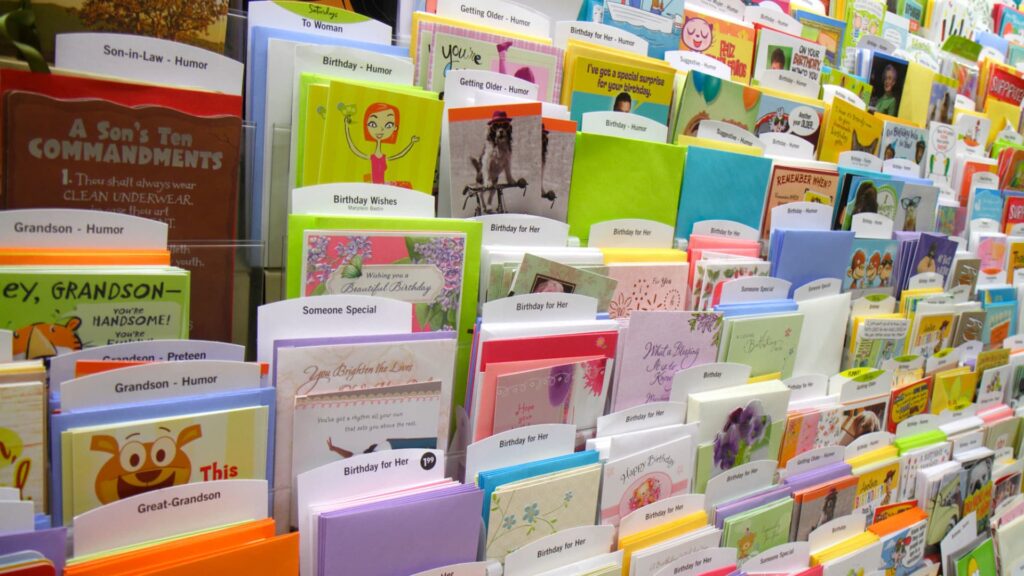

UK-based greeting cards and gifts retailer Card Factory is on the cusp of a major growth phase, with its shares likely to rise by more than 115% over the next 12 months, according to analysts at Investec. Analysts at the bank called the London-listed stock “significantly undervalued” after it announced earlier this month it would resume dividend payments after a five-year hiatus. The stock also trades OTC in the United States and has a dividend yield of 6.5%. Investec analysts led by Kate Calvert said in a June 18 research note to clients: “Over the past three years, management has restored balance sheet strength and successfully achieved operational and financial turnarounds.” Investec will The price target was raised to £2 ($2.53 per share), implying an upside potential of 116%. UK stocks are usually priced in pennies, with 100 pence equaling 1 pound ($1.28). CARD-GB 5Y line Founded in the north of England in 1997, the company has grown rapidly and operates more than 1,000 stores across the UK, but suffered a near-death experience during the Covid-19 pandemic, when most of its entities Properties were forcibly closed. However, earlier this month, Card Factory said its profitability had improved in fiscal 2024 and the company expected to return to normal growth rates. Calvert said the company’s pre-tax margin was 12.2%, which exceeded the industry average. She added: “Despite another year of growth, a return to dividends and a return to normal funding conditions, we believe CARD is significantly undervalued.” However, not all analysts share Investec’s optimistic outlook. Investment bank UBS took a more cautious view on Card Factory’s near-term prospects. UBS analyst Saranja Sivachelvam said in a June 12 research note to clients: “We believe Card Factory’s strategy of increasing store space and building share in the gifts and celebrations market can support long-term sales growth and margins. “Given the uncertainty in the market, we remain cautious in the short term. UBS expects Card Factory to post profits of £65m in the next financial year on sales of around £535m. The investment bank raised its price target to £1.16 per share, indicating 26% upside potential, but Also maintained a “neutral” rating. “At our target price, we would see the company trading at [8.7 times forecast price to earnings ratio]which is consistent with its [five-year] It averages 8.6x and does not see any major re-rating triggers in the next 12 months, keeping us Neutral,” Sivachelvam added.

Analysts say the global retailer’s shares could rise as much as 115%

Related Posts

Add A Comment