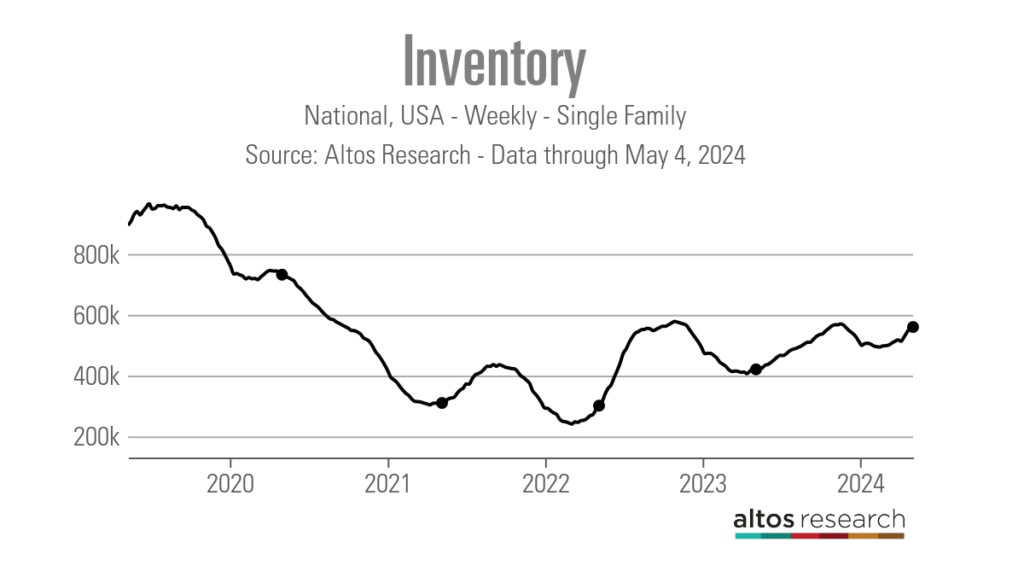

My model of inventory growth versus rising mortgage rates collapsed last week. After two weeks of significant growth, inventory growth has slowed significantly and is far from what I expected. 11,000-17,000 Mortgage rate growth model over 7.25%. Is the recent drop in mortgage rates playing a role here, or is this the average weekly swing in data we’ve seen over the past few years? Let’s dig into the weekly data and see what we can find.

Weekly housing inventory data

I’m looking for a hat trick this week after higher mortgage rates drove more inventory growth, but last week stalled.It’s worth noting that weekly data can fluctuate, so I wouldn’t overreact to a slow week of inventory growth numbers, but it’s disappointing to just see 3,453 new homes were added. Last year, stocks also declined week by week during the same time period, so always remember that trends are more important than one week’s worth of data. Please note that we do have Mother’s Day weekend next week.

- Weekly inventory changes (April 26 to May 3): Inventories rose from 556,291 arrive 559,744

- Same week last year (April 28-May 5): Inventory decline 421,924 arrive 420,489

- Historical inventory bottom occurs in 2022 240,194

- The inventory peak in 2023 is 569,898

- For some cases, this week’s active list is at 2015 yes 1,081,867

New listing data

New listings data has been positive throughout the year as we see continued growth in levels in 2023, which saw new listings levels hit a record low. I wish the new listings had grown faster, but nonetheless, I’d call it a win. We are seeing a slight weekly decline in new listings data. Now, I attribute that to the seasonal fluctuations we sometimes see in inventory data. Here are last week’s new listings data for the past few years:

- 2024: 70,954

- 2023: 57,682

- 2022: 76,095

Price reduction percentage

On average, one in three homes loses price every year—standard housing activity. When mortgage rates rise, demand falls and the price reduction percentage rises. When interest rates fall and demand improves, this percentage decreases.

Price reduction percentage growth in 2024 will be much slower than in 2022, which saw larger price reductions. The second half of 2022 saw the largest and fastest decline in home sales ever recorded, and after November 2022, the epic home sales collapse stalled. This could explain why the slope of the price cut curve is faster and stronger in 2022 than in 2023 or 2024 so far.

- 2024: 33%

- 2023: 29%

- 2022: 20%

10-Year Yield vs. Mortgage Rates

We have an exciting week ahead for 10-year Treasury yields and mortgage rates. The Fed is trying to maintain a balanced stance on the timing of its next rate cut, which I talked about on the HousingWire Daily podcast.

Later, the 10-year Treasury yield fell after a jobs report showed slowing wage growth. I wrote about the slowdown in wage growth and its relationship to the Fed’s pattern in my analysis of the jobs report. Taking all of these factors into consideration – highlights from the Fed meeting, weakness in job openings and Friday’s jobs data – could explain last week’s decline in yields and mortgage rates.

Mortgage spreads have been terrible for some time, but 2024 is still far from the 2023 peak pressure we see in this data line. 0.52% Currently higher. Therefore, the improvement in spreads this year is a positive storyline. I didn’t anticipate that we would see this before the Fed started cutting rates, so I made that mistake in 2024.

Purchase application data

Last week’s purchase application data was again unchanged, down 2% from the previous week and down 14% from the same period last year. Keep in mind that context will be critical for any growth we see in this data line going forward, as we’re working from the lowest levels ever.

Since mortgage rates began to fall in November 2023, we have 11 positive photos relatively nine negatives and Two flat prints weekly.So far this year we have five positive filmsNine negative printing, and Two flat prints.

The week ahead: Bond market digests

There was a lackluster week on the economic front, including unemployment benefits data, used car prices and some speeches from the Fed chair. I will be keeping a close eye on the 10-year Treasury yield. The bond market moves like crazy whenever jobs week is combined with a Fed meeting, so I’m interested to see how the market reacts after digesting what happened last week.