Michael M. Santiago/Getty Images News

Volatility in the options market was higher than usual on Wednesday, according to Bank of America, which advised investors to protect gains, especially in small-cap stocks, after a recent “historic” surge.

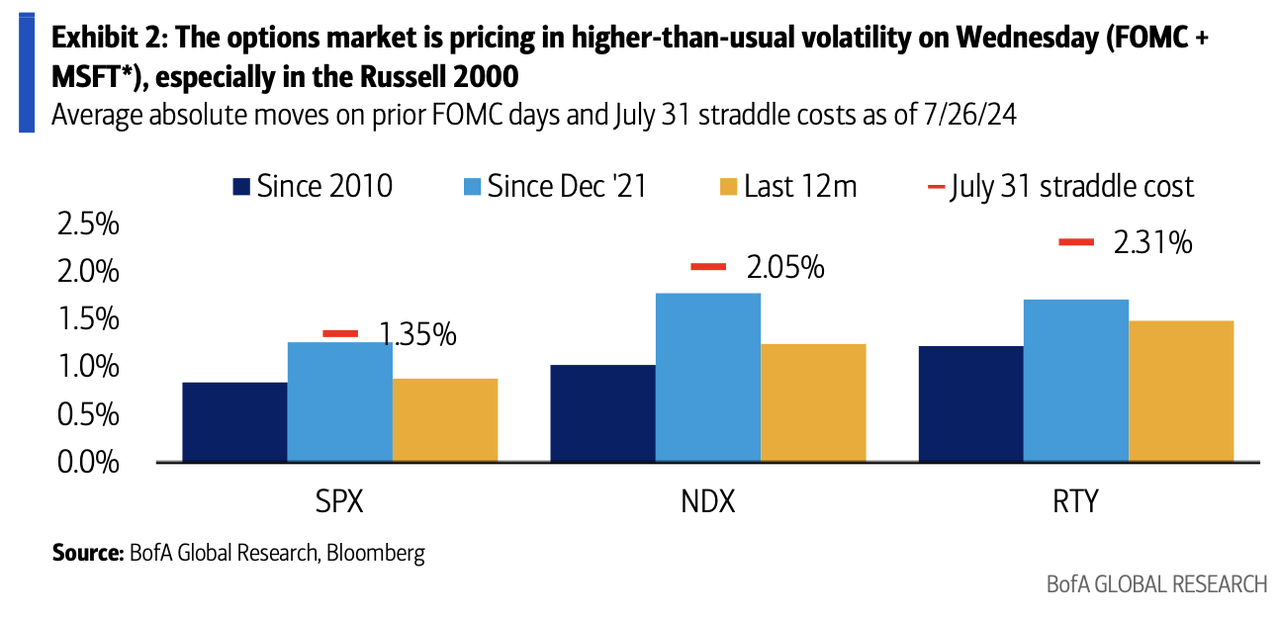

Pricing volatility in options markets is higher than usual, especially in Russell 2000 (RTY) small-cap index, Bank of America said in a report. On Wednesday afternoon, investors will be looking for signals from the Federal Reserve that it may start a rate-cutting cycle this year. Until then, the market will have grasped the Microsoft (Microsoft Corporation), one of the seven giant technology stocks.

“Wednesday’s implied RTY move is 2.31%, and while the recent rise in correlations with spot moves in the Russell 2000 index has made outright puts expensive, put spreads remain an option for investors to hedge against the possibility of RTY (RTY) following the historic run. An attractive way to pull back, Ohsung Kwon, equity and quantitative strategist at Bank of America, said in a note.

Bank of America said the shift away from large-cap tech stocks into small-cap stocks has led to notable moves in the Russell 2000 Index (RTY) this month, including the best five-day performance relative to the Russell 1000 Index since 1979. A market shift triggered by a resurgence in interest rate cut expectations caused the Russell 2000 Index (RTY) to surge about 9% in July.

Kwon said a lower Russell 2000 index (RTY) is not the base case for U.S. banks. But he said strong tech earnings and/or a hawkish Federal Open Market Committee “showing hesitancy” on cutting interest rates in September after last week’s stronger-than-expected second-quarter GDP report could contribute to near-term losses in small-cap stocks. Tech sector results from Meta (META), Apple (AAPL) and Amazon (AMZN) are also due this week.

Bank of America released this chart of options market pricing:

Here are some small-cap ETFs to track: (IJR), (IWM), (VB), (DFAS), and (SCHA).