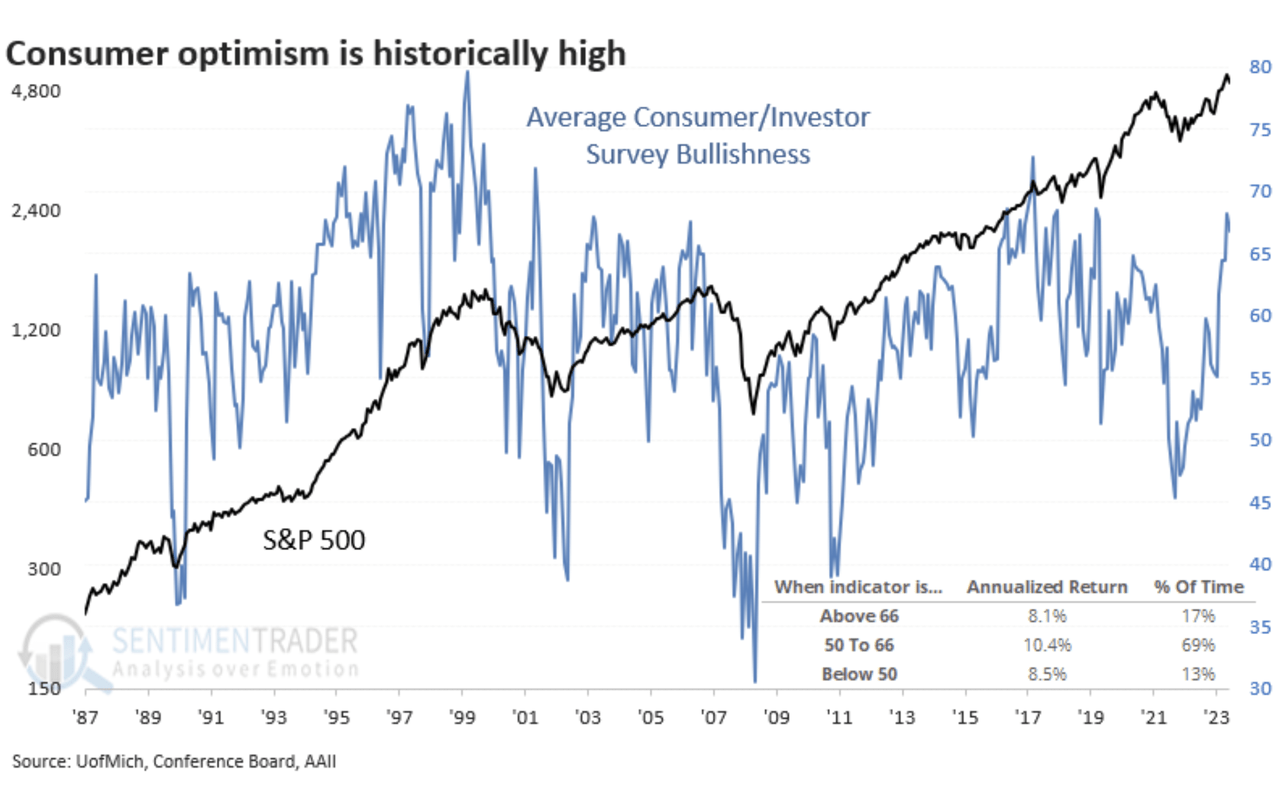

Optimism among rank-and-file U.S. stock investors has been growing since the market suffered huge losses in 2022, data from SentimenTrader shows, with the stock market’s gains drawing attention from the broader consumer class.

The research firm shared a Chart on X (formerly Twitter) showed this week that after a “brutal 2022,” a recovery in 2023, and a “good start” to the year, consumer optimism has reached an all-time high and is spreading more broadly across the U.S. among consumers.

“Nearly everyone now knows how strong the stock market is,” the investment research firm said.

“Three major surveys that combine investor stock allocations show that as of the end of April, investor sentiment was at its highest level in decades, especially the past two years,” SentimenTrader said, referring to the University of Michigan, Major World Enterprise Consumer surveys conducted by the Federation and the AAII Investor Sentiment Survey.

Another investment research company, Bespoke Investment Group, said in 2022 that this year was the worst year for investor sentiment since the AAII investor sentiment survey began in 1987.

In 2022, the S&P 500 Index (SP500) (VOO) (IVV) fell about 19% as surging inflation prompted the Federal Reserve to start raising interest rates. The benchmark surged about 24% in 2023 and is up about 8% so far in 2024.

The latest AAII sentiment survey shows an increase in optimism among individual investors about stocks’ short-term prospects, while pessimism and neutral sentiment have declined.

Here are some consumer discretionary and staples ETFs to track:

- Consumer Discretionary Select Sector SPDR Fund (XLY)

- First Trust Consumer Discretionary AlphaDEX Fund (FXD)

- iShares Global Consumer Discretionary ETF (RXI)

- Vanguard Consumer Staples ETF (VDC)

- Invesco S&P 500 Equal Weight Consumer Staples ETF (RSPS)

- Fidelity MSCI Consumer Staples Index ETF (FSTA)