Following reports that E*Trade may kick meme stock guru Roaring Kitty off its platform, some of his fans are questioning whether his alleged market manipulation isn’t exactly what politicians and Wall Street traders do every day.

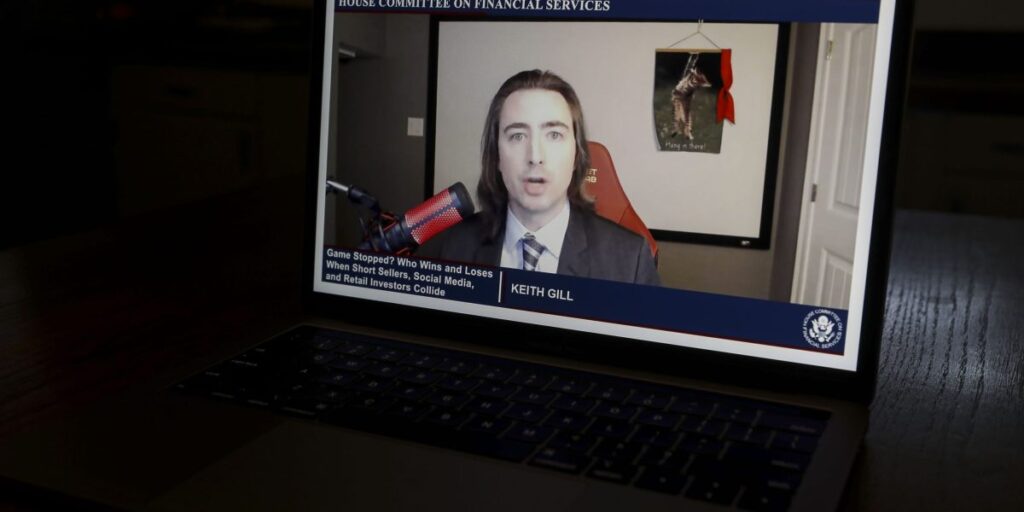

Senior leaders at Morgan Stanley’s brokerage firm are concerned that Roaring Kitty, whose real name is Keith Gill, has huge online influence that could lead him to manipulate stocks for his own benefit. wall street journal The report quoted people familiar with the matter as saying. Those at E*Trade and Morgan Stanley weighing the decision are particularly concerned about the massive number of options Gill bought before his first social media post last month helped revive the GameStock trade. A screenshot of Gill’s brokerage account this week showed he held $260 million in the stock.

Since returning to social media last month after a three-year hiatus, Gill has posted a series of cryptic posts on X. The company’s shares have risen 56% since Gill’s last trading day before returning to social media.

Reports that Gill may be banned from E*Trade have reignited the anti-establishment uproar that first fueled 2021’s meme stock frenzy, as highlighted in the video stupid money. At the time, retail traders attacked hedge funds such as Ken Griffin’s $62 billion Citadel and now-defunct Melvin Capital, accusing them of rigging the game.

While it’s unclear whether E*Trade will actually ban Gill or drop the issue, some fans of the retail investor say what he’s doing is no different than what Wall Street bigwigs often do.

One Reddit fan named CedgeDC wrote: “How could national TV be hyping up stocks or telling people what to buy, not market manipulation, but that’s what it is.”

Wall Street traders and other experts often appear on television to talk about public companies. Short sellers are especially known for their wages public events for the stocks they are shorting.

Some on social media also pointed out that politicians often trade stocks without breaking the law, even in companies directly affected by their legislative committees.

Morgan Stanley’s E*Trade is considering banning Keith Gill, aka “Roaring Kitty” or “DeepFuckingValue,” from its platform over concerns that his recent purchase of GameStop options may have been a source of stock manipulation. .

So… politicians can take advantage of insider trading…

— Capital (@CapStonkHQ) June 3, 2024

As of Monday’s update on Reddit, Gill, whose Reddit alias is Deep F——Value, owned about $140 million worth of GameStop stock. The U.S. Securities and Exchange Commission is also reportedly investigating options trades made before and after Gill’s tweet, Magazine According to reports, though it’s unclear whether they are investigating Gill directly.

A spokesperson for E*Trade declined to comment on whether it was considering kicking Gill off the platform. An SEC spokesman said it would not comment on the existence of a possible investigation. Gill did not immediately respond to a direct message on Reddit.

While E*Trade is considering whether to ban Gill, it is also weighing whether the move would spur user exodus from the platform. Some Morgan Stanley employees speculated that if Gill stood up to them on X, his 1.4 million followers on X might soon switch to the platform. Magazine.

The distrust of institutions among Gill’s army of loyal retail traders means E*Trade’s hesitation only endears him to them.

“It’s an interesting move from E*Trade. If they’re considering killing Roaring Kitty, it only proves that they’re onto something big. release on X.