I saw a couple of statements this morning after the CPI was released that I’m pretty sure were written last night. It’s almost like crazy freedom fills up the numbers.

However, when I spoke to Citi U.S. economist Gisela Hoxha, she was optimistic about the numbers. In particular, core inflation was much lower than expected.

Hoxha pointed out that as inflation began to decline last year, deflation was mainly reflected in commodity prices, while service industry prices remained high.

There were some changes in today’s data, with some of the stickier services components of the CPI slowing. “The trend actually points to a weaker some of the service components, such as auto insurance, personal services,” Hoxha said.

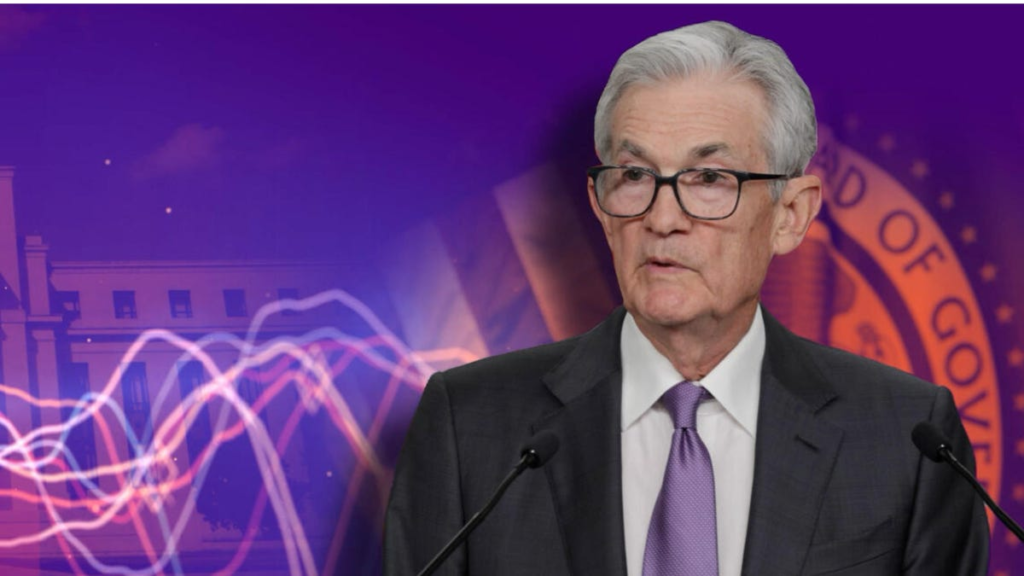

Although the housing index continues to remain elevated (again up 0.4% month-on-month), these softer numbers may put Fed Chairman Powell in a better mood during today’s post-FOMC press conference.

Hoxha also pointed out that we expect more data, including labor market data, to be released before the next Fed meeting in late July. Citigroup predicts the Fed will cut interest rates three times this year, in September, November and December. But July is certainly a possibility, she said.

We’ll keep you updated as we speak to more experts.