Federal Reserve policymakers said they would slow the pace of “quantitative tightening” to $40 billion per month, less than half of what they envisaged two years ago.

Held July 30-August at Inman Connect Las Vegas. On January 1, 2024, the noise and misinformation will be cut away, all your big questions will be answered, and new business opportunities will be revealed. join us.

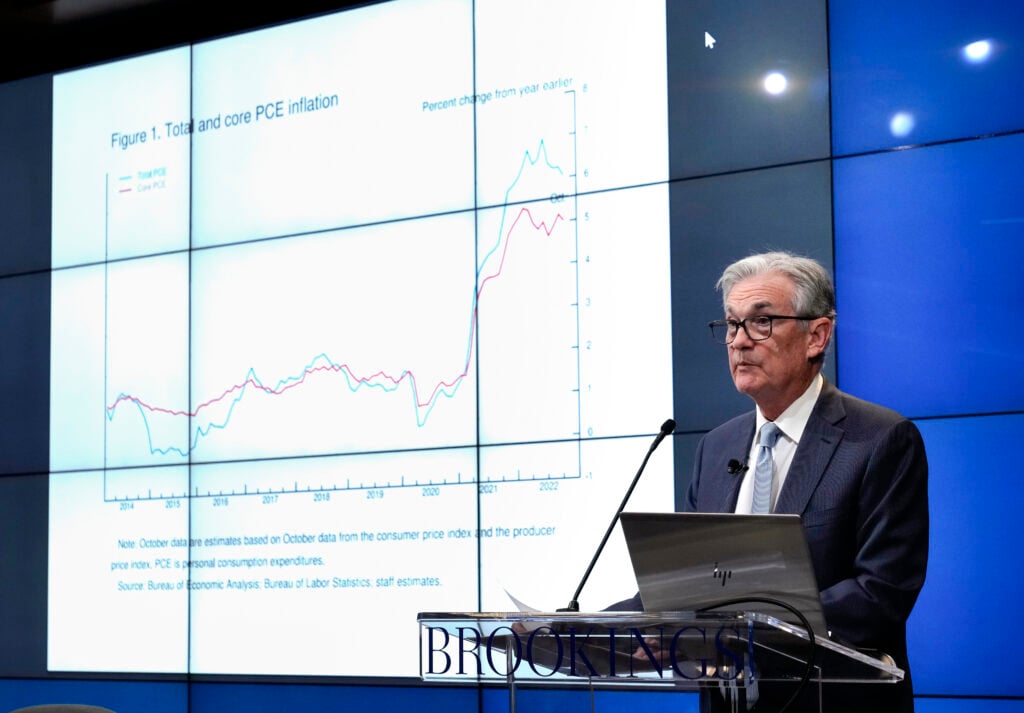

On Wednesday, Federal Reserve policymakers said they would slow the pace of “quantitative tightening” — the central bank’s reduction of its $7 trillion balance sheet that helps keep interest rates high — to half the pace expected two years ago. the following. .

At its latest meeting, the Federal Reserve kept the short-term federal funds rate unchanged at its current target of 5.25% to 5.5%, in line with expectations.

However, based on guidance provided by Fed Chairman Jerome Powell in March, the Fed will slow down the pace of reducing its holdings of long-term Treasury bonds by $35 billion per month on June 1.

As the Fed misses its goal of reducing its holdings of mortgage-backed securities (MBS), the Fed’s shrinking balance sheet will soon total just $40 billion a month — less than what policymakers set. Half of the $95 billion target by 2022.

“The decision to slow down the runoff does not mean that our balance sheet will end up shrinking less than it would have otherwise, but it will allow us to get closer more gradually,” Powell said at a press conference after the Fed’s latest meeting. its ultimate level.

“In particular, slowing the rate of runoff will help ensure a smooth transition and reduce the likelihood of money market stress, thereby facilitating a sustained decline in our securities holdings consistent with reaching appropriately adequate levels of reserves.”

10-year Treasury yields fall from 2024 highs

Source: Yahoo Finance.

The 10-year Treasury yield, a useful barometer of where mortgage rates will go next, fell 9 basis points on Wednesday to 4.59%, down 15 basis points from the 2024 high of 4.74 set on April 25.

But Marty Green, a principal at mortgage law firm Polunsky Beitel Green, noted that the chances of the Fed cutting interest rates this year appear to be diminishing.

Marty Green

“Given that inflation data continues to show a bumpy road to the Fed’s 2% inflation target, it is not surprising that the Fed has chosen to keep interest rates on hold and postpone the prospect of a rate cut until later this year,” Green said in the report. ” a statement.

“The question now is whether inflation will become so sticky that the Fed decides not to consider a rate cut in 2024 and instead delays it until 2025.”

CME Group’s FedWatch tool, which tracks the futures market to predict the likelihood of future Fed actions, showed on Wednesday that the probability of the Fed cutting interest rates multiple times this year was only 42%, down from 85% on April 1.

Green described the Fed’s decision to reduce the pace of balance sheet tightening as “good news.”

“Over time, this adjustment should have some positive impact on interest rates without the Fed having to adjust the federal funds rate,” Green said.

The Fed will slow down the pace of “quantitative tightening”

Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

While the Fed tightly controls short-term rates, long-term rates on government debt and mortgage-backed securities are driven by supply and investor demand.

In order to prevent the economy from collapsing during the epidemic, the Federal Reserve not only cut short-term interest rates to 0%, but also purchased $120 billion in debt every month, including $80 billion in long-term Treasury bonds and $40 billion in MBS.

With its balance sheet approaching $9 trillion, the Federal Reserve changed its “quantitative easing” approach and implemented “quantitative tightening” as part of its efforts to combat inflation.

In 2022, the Federal Reserve will intensify its “quantitative tightening” efforts, aiming to reduce US$60 million in US Treasury bonds and US$35 billion in MBS from its balance sheet every month. Rather than maintaining the status quo by replacing $95 billion in maturing assets, the Fed will write these assets off its books.

Now, instead of keeping $60 billion in monthly government debt on its books, the Fed has set a new cap on monthly Treasury redemptions at $25 billion per month.

Although the Fed retained MBS’s $35 billion runoff cap, it was unable to achieve that goal. As rising mortgage rates slow down the rate at which borrowers can refinance their mortgages, the Fed will only be able to reduce its mortgage holdings by $15 billion per month for some time.

Asked whether there was a contradiction in the Fed keeping short-term interest rates steady to try to cool the economy while slowing the pace of quantitative tightening, Powell said interest rates are “an active tool of monetary policy.”

He said Fed policymakers were slowing the pace of quantitative tightening to avoid the kind of chaos in money markets they experienced when they last tried to reduce their balance sheets in 2019.

“This is the plan we’ve had for a long time … not to ease the economy or reduce restrictions on the economy,” Powell said. “Really, it’s about making sure that the process of shrinking the balance sheet to where we want it to be is. Smoothly, and without causing turmoil in financial markets like the last time we did this – the only time we’ve ever done this.

Get Inman’s mortgage newsletter delivered straight to your inbox. A weekly digest of all the biggest news in mortgages and settlements around the world is published every Wednesday. Click here to subscribe.

Email Matt Carter