this federal housing administration The Federal Housing Administration announced Friday that it has published a final rule in the Federal Register opening up remote and electronic communications between mortgage lenders and defaulted borrowers. The move is aimed at broadening the way borrowers can meet with lenders, following the success of remote communication about housing issues during the COVID-19 pandemic.

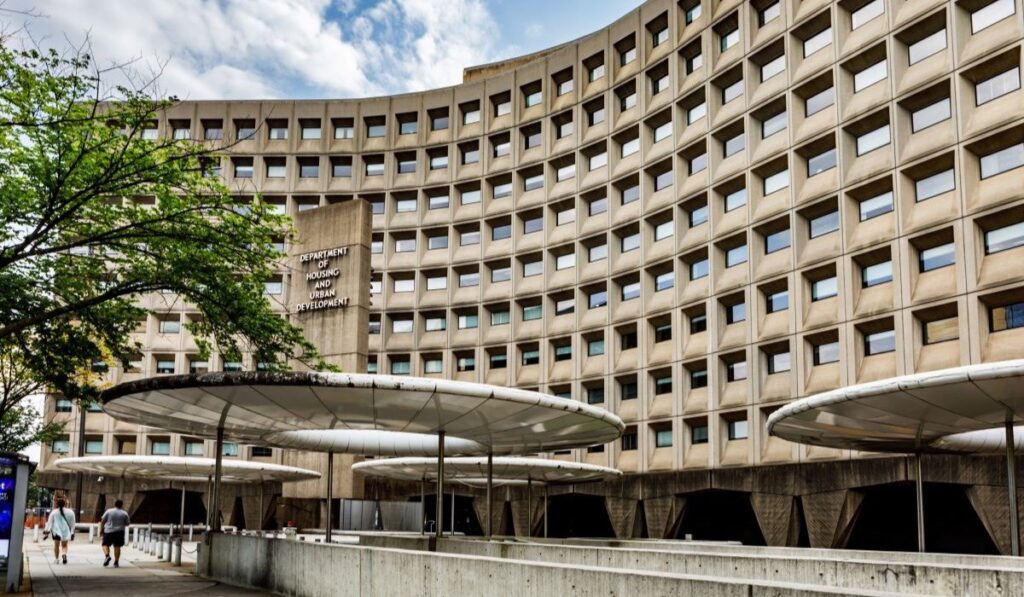

this U.S. Department of Housing and Urban Development (HUD) said last summer it would explore such a policy, saying the rules currently in place are outdated and do not take into account modern communications methods consistent with the protection of the personal information of all parties involved.

“This final rule updates HUD’s current regulations that require mortgage holders to meet in person with borrowers who are delinquent on their mortgage payments,” the announcement states. “The final rule allows the use of electronic and other remote communication methods to satisfy HUD with delinquent borrowers. Meeting request.”

The updated regulations are designed to “accommodate advances in electronic communications technology and borrower participation preferences while retaining necessary consumer protections,” the FHA explained. The final rule is scheduled to take effect on January 1, 2025.

The rules published in the Federal Register still emphasize that lenders should strive to hold in-person meetings, but add four provisions that do not require in-person meetings.

An in-person meeting is not required if the lender does not reside at the mortgaged property, or if the mortgaged property is not within 200 miles of the lender, servicer, or applicable branch.

Other circumstances include when the borrower “clearly indicates that he will not cooperate with the interview,” if a repayment plan is developed that is consistent with the borrower’s circumstances, rendering the meeting redundant, or “reasonable efforts to arrange a meeting have been unsuccessful.”

HUD added that a draft mortgagee letter (ML) detailing these provisions will soon be posted on its Single-Family Drafting Form, an online portal to review proposed HUD single-family units before they become fully effective. policy.

Previously, the Federal Housing Administration (FHA) issued a regulatory exemption allowing lenders to use remote communication tools during the epidemic, which was recently extended in April to January 1, 2025.