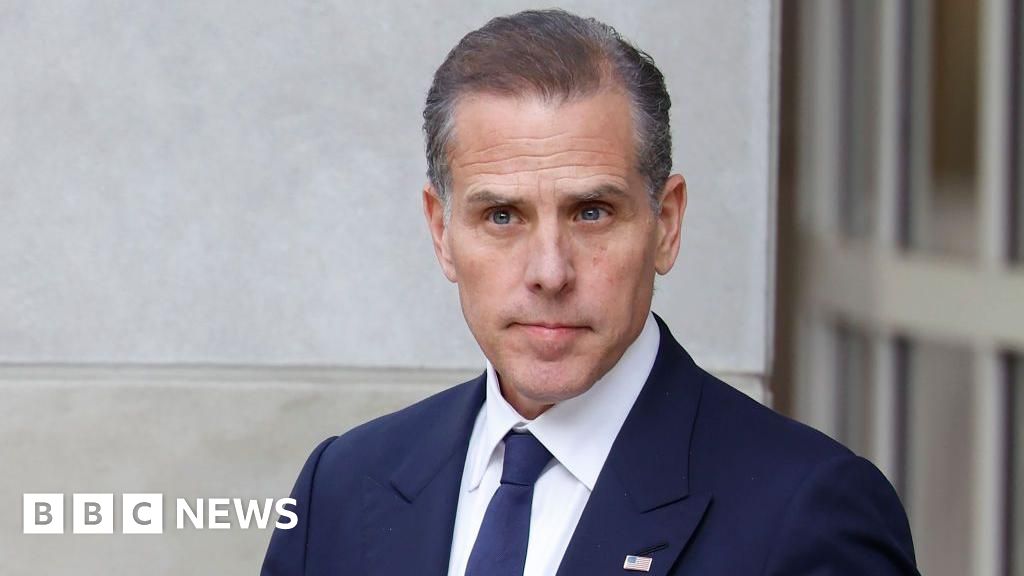

Hunter Biden has pleaded guilty in a federal tax evasion case, appearing to surprise federal prosecutors as they prepare to start a trial on Thursday.

Biden has previously denied accusations that he deliberately evaded paying $1.4m (£1m) in income tax between 2016 and 2019.

Biden, 54, initially said he wanted to enter what is known as an Alford plea, in which he accepts the charges while maintaining his innocence, but then simply said he would plead guilty when prosecutors objected.

After prosecutors read the 56-page indictment against him to the court, the judge asked Biden if he agreed that he “committed all elements of each crime with which he was charged.”

“I do,” Biden said.

He first announced the last-minute reversal Thursday in a Los Angeles courtroom as jury selection was about to begin, his second conviction this year.

Biden’s attorney, Abe Lowell, said his client wanted to waive the trial “out of personal interest” to avoid having his friends and family testify about what happened “when he was addicted to drugs.”

Judge Mark Scarsi said Biden would face up to 17 years in prison and a fine ranging from $500,000 to $1 million after pleading guilty to all nine counts.

There is a portrait of the president in every federal courthouse across the country, and Biden, accompanied by his wife, lawyers and Secret Service agents, had to walk past his father’s portrait on his way to the courthouse.

President Joe Biden has previously said he would not use executive power to pardon his son.

Prosecutors representing President Joe Biden’s Justice Department said they were “shocked” by Alford’s plea recommendation and were unwilling to agree to the deal if it would keep Hunter Biden innocent.

“Hunter Biden is not innocent. Chief Prosecutor Leo Wise said in court that Hunter Biden is guilty.

“We are in court today to hear this case.”

Biden had previously tried to dismiss the case, saying the Justice Department investigation was politically motivated and that he was targeted because of Republican lawmakers’ efforts to impeach his father.

He also argued that the appointment of special prosecutor David Weiss to the case was illegal.

Those arguments were rejected by Judge Scarce, who was appointed by Trump to oversee the case.

The president’s son was charged in December with three tax felonies and six misdemeanors. These include failure to file and pay taxes, tax evasion and filing false returns.

According to the indictment, Biden earned $7 million from 2016-19 through overseas business transactions.

The indictment also alleges that he spent nearly $5 million during this period on “all expenses except taxes.”

The indictment said the purchases included drugs, escorts, luxury hotels, luxury cars and clothing, which Biden allegedly falsely labeled as business expenses.

Prosecutors said Biden’s actions amounted to “a four-year plan.”

“In each year that he failed to pay his taxes, defendant had sufficient funds to pay some or all of his unpaid taxes when due,” the indictment states. “But he chose not to pay them.”

His tax evasion trial marks Biden’s second federal criminal prosecution this year.

In June, he was convicted of gun possession and drug-related charges, becoming the first son of a sitting U.S. president to be convicted.

Specifically, Biden was convicted of three felony charges related to his purchase of a revolver in 2018 while battling drug addiction and for lying about his drug use on a federal form for the gun purchase.

After the gun and tax charges were first brought, Biden reached a plea deal with federal prosecutors that later fell apart.

He received nothing in return for pleading guilty Thursday other than avoiding a public trial.