We have less than a month to go List our Brooklyn, NY apartments, we purchased it for $375,000 in 2004, the same week we got married. 20 years, two kids and a chocolate lab later, we’re selling the condo for close to $1 million, and then… Chapter 1031 Exchange. (newcomer? follow up In the last few monthly letters!

As a reminder, we haven’t made much cash from this property over the past 20 years. Growth all comes from equity—now is the time to cash in!

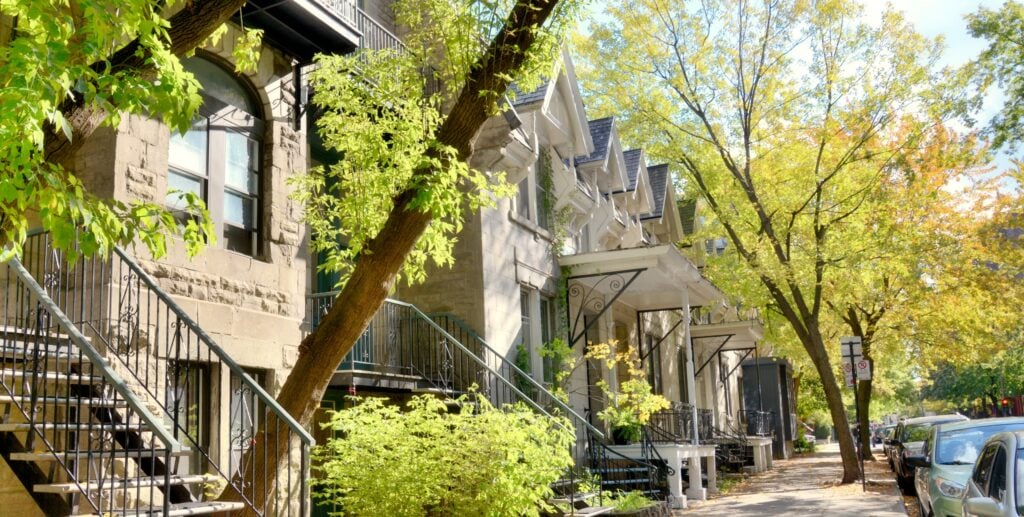

So far we have Locked in to our Brooklyn sales team and had some great meetings with developers and real estate agents in our top five markets, including:

- saint antony

- dallas

- cleveland

- jacksonville

- Tampa/St. saint petersburg

Transaction process

We’re already starting to see deals trickle in. We went BiggerPockets Proxy Finder and find agents in our target markets. I then spent about a week having live conversations with each of them, sharing our buy boxes and hoping to see more great options. It certainly worked: My email inbox is now filled with potential multifamily deals ripe for underwriting.

Good at underwriting

This month we have set a goal to underwrite at least 50 properties that could be serious contenders. We’re not there yet, but this has already helped us in many ways:

- It makes us better at underwriting.

- It allows us to see patterns so we can easily eliminate properties by looking at the initial numbers without having to go all the way to full underwriting.

- It gives us a better understanding of the land.

- To sleep better at night, we realize we need to be conservative with our estimates across the board.

Aiming at new construction

One thing we learned from this is that if we wanted a turnkey, beginner-friendly new build, we probably wouldn’t be able to achieve our $5,000 monthly cash flow goal in every target market, at least for the first few years of ownership. .

New builds have advantages and disadvantages: they usually mean less initial hassle and, of course, less money spent on capital outlay and maintenance. In some cases, they also mean buying directly from developers, who can lower interest rates – a surprising advantage in this environment.

They also have disadvantages. When you close, of course they are empty. All the underwriting and monthly cash flow calculations won’t materialize unless you fill the place up with tenants. You hope this will happen within a few months, but you never know. Likewise, rentals are unconfirmed. You can and do make your best, data-backed guesses, but you’ll never know until your first tenant signs their first lease. Of course, you pay close to the top price for new construction because all the work has been done for you.

We have to decide which new builds are valuable to us.

We are also always looking for older buildings with existing tenants that have better cash flow (and possibly existing building issues). But we remain cautious about large-scale first-time out-of-state purchases.

Here’s one of the new deals we’ve been keeping an eye on:

- Brand new, 8 units, purchase price 2.2 million (we should have about 850,000 in cash).

- The unit is 3/2.5.

- Mid to high appreciation market (we have been using 2%/year in our calculations, but it should be higher).

- Developers are slashing purchase prices.

- If we have problems getting LTR tenants, there are MTR (medium term lease) opportunities.

- We include property management in our analysis.

- After stabilization, the monthly cash flow is about 4k.

It might not be a home run, but it might be a solid base hit to get us started. what do you think?

Our 1031 journey so far:

January: Selling our apartment, begins

February: Locate the seller

March: 1031 Are exchanges really worth it?

This 1031 Diary will be a monthly series through 2024, documenting our journey to a (hopefully) successful and profitable 1031 exchange starting in May. We’ll share everything – all the data, analysis, good decisions, what we wish we’d done differently, the big mistakes (hopefully not a lot) and everything in between. Have questions? Any suggestions? What do we lack? Share it in the comments below!

Are you ready to succeed in real estate investing? Set up a free BiggerPockets account to learn about investing strategies; ask questions and get answers to our community of over 2 million members; connect with investor-friendly agents; and more.

Notes on BiggerPockets: These are the opinions written by the author and do not necessarily represent the views of BiggerPockets.