ArLawKa AungTun/iStock via Getty Images

Despite optimism about rate cuts, large-cap property stocks started the second half of 2024 with modest weekly losses as conditions in the sector weighed on sentiment.

S&P 500 Advanced Index 1.95% Starting last week, with Labor market data supports a rate cut by the Federal Reserve. The probability of a 25 basis point rate cut in September is now 72.0%, compared with It was 47.0% in early JuneCME Group FedWatch Tool show.

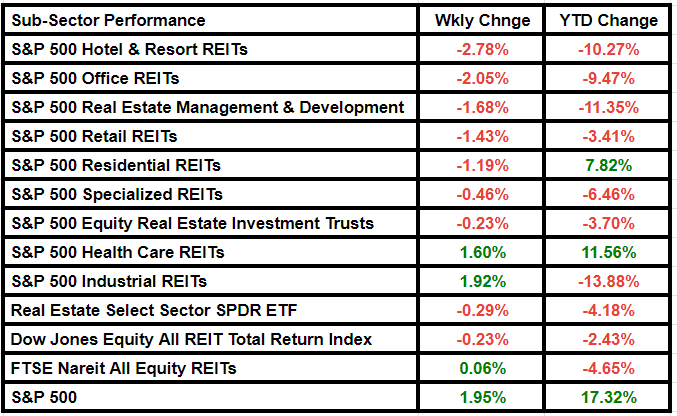

Real estate investment trusts benefited from waning investor pessimism. The FTSE Nareit All-Share REITs Index, which consists of all tax-qualified REITs with qualifying real estate assets accounting for more than 50% of total assets, rose. 0.06% once a week.

However, the Real Estate Select Sector SPDR ETF and the Dow Jones Equity All-REIT Total Return Index fell 0.29% and 0.23%respectively.

Much of the commercial real estate industry continues to deteriorate, with debt delinquency rates rising and property values declining. Seeking Alpha analyst Bret Jensen said in a recent research note that things are likely to get worse before they get better.

The commercial real estate market continues to face challenges from rising interest rates and increased supply, while the housing market is undersupplied.

Citi downgraded homebuilders Lennar (LEN) and DR Horton (DHI) to “neutral” from “buy” due to weak housing activity this summer.

Home furnishings retailer RH (RH) admitted it was the “most challenging housing market in three decades” and warned that “the changing outlook for monetary policy will continue to weigh on the housing market in the second half of 2024 and even into 2025” ”.

Mortgage application volumes fell this week as interest rates rebounded.

During the first presidential debate of the 2024 election cycle between President Joe Biden and former President Donald Trump, Biden promised to lower home prices and increase inventory. But Realtor.com quoted economist Ralph McLaughlin in an article as saying the topic of housing came up only twice in the debate, meaning housing is unlikely to be a focus.

“There are still too many families in this country facing housing insecurity and hardship, and too little national discussion about it,” McLaughlin said.

XLRE net outflow value $161.31 million Compared to this week’s inflows $213.57 million Last week, data from information solutions provider VettaFi showed.

Seeking Alpha’s Quantitative Ratings system changed the ETF’s recommendation from Hold to Sell, while SA analysts rated the fund a Buy. Meanwhile, Citi Research said the S&P 500 has more room to rise and focused on real estate as a sector for which it has an overweight stance.

SBA Communications (SBAC), Host Hotels & Resorts (HST), Weyerhaeuser (WY), Simon Property Group (SPG) and VICI Properties (VICI) were the top losers in the S&P 500 real estate sector this week. Alset (AEI), Logistic Properties of the Americas (LPA) and La Rosa Holdings (LRHC) were other notable sector losers.

The following is the performance of this week’s sub-sectors: