In the most anticipated quarter of this earnings season, Nvidia’s revenue and profits far exceeded high expectations. Even better was CEO Jen-Hsun Huang’s hefty revenue guidance and broader vision, which reinforced the idea that companies and countries are working with the AI chip giant to shift $1 trillion worth of traditional data centers toward accelerated computing. Data from data provider LSEG (formerly Refinitiv) showed that revenue in the first quarter of fiscal 2025 increased 262% year-on-year to US$26.04 billion, much higher than analysts’ forecast of US$24.65 billion. The company had expected revenue of $24 billion, plus or minus 2%, so this is a huge breakthrough. Adjusted earnings per share grew 461% to $6.12, beating the LSEG consensus estimate of $5.59. According to market data platform FactSet, the adjusted gross profit margin was 78.9%, which also exceeded Wall Street expectations of 77.2%. The company estimates gross profit margin to be 77%. Plus or minus 50 basis points. In addition to the strong results, Nvidia also announced a 10-for-1 stock split. While stock splits don’t technically create value, they do have a positive impact on stocks. The company said the split was to “make equity more accessible to employees and investors.” We commend Nvidia for doing this and will continue to urge other companies to do the same. Nvidia recently conducted a 4-for-1 stock split in July 2021. Not surprisingly, Nvidia shares soared in after-hours trading. Nvidia Why we have it: Nvidia’s high-performance graphics processing units (GPUs) are a key driver behind the artificial intelligence revolution, powering accelerated data centers being rapidly built around the world. But this isn’t just a hardware story. Through its Nvidia AI Enterprise service, Nvidia is building a potentially huge software business. Competitors: Advanced Micro Devices and Intel Last purchased: August 31, 2022 Launched: March 2019 Bottom line What are air pockets? Heading into the quarter, it sounds like the only thing that may be holding Nvidia back is a slowdown related to product transitions, as customers delay orders for H100 and H200 GPUs (graphics processing units) in anticipation of the superior Blackwell chip platform. As you can see from Nvidia’s massive growth and upside guidance, that’s far from the case, with demand expected to outpace supply for quite some time. If this narrative resurfaces, here’s a good thing to remember next time so these concerns don’t shake your long-term thesis: Customers are still in their early stages, Jensen explained on the post-earnings call. Keep buying chips to keep up with the current technological arms race. Technology leadership is everything. “There’s going to be a bunch of wafers coming at them, and they have to keep making them, averaging performance, if you will. So that’s a smart thing to do,” the CEO said. More broadly, we heard nothing Wednesday night to change our long-term view of how Nvidia could be the driving force behind the current artificial intelligence industrial revolution. Here’s how Jensen explains the shift taking place: “In the long term, we are completely redesigning the way computers work. This is a platform shift. Of course, it compares to other platform shifts in the past, but time will tell Tell us, this is a platform shift. Jensen went on to mention how the computer not only interacts with us, “but it also understands what we mean, what our intentions are in asking it to do it, and it has the ability to reason, iteratively reason to process and Plan and return a result. Solution. “We spend billions on accelerated computing, which is why we hold Nvidia for the long term rather than trying to trade it back and forth on every headline. By the way, another pessimistic statement we often hear is that the custom chips that all the big cloud companies are producing are a threat to Nvidia’s leadership. Jensen doesn’t think so because his platform systems deliver the highest performance at the lowest total cost of ownership. This is an unrivaled value proposition. NVDA YTD mountain Nvidia YTD Strong results and outlook, upbeat comments and a stock split sent Nvidia shares up about 6%, topping $1,000 per share for the first time. However, we think the benefits don’t stop there. We raised our price target from $1,050 to $1,200 and maintained a 2 rating, meaning we view this as a Buy on a pullback. Quarterly growth was driven by all customer types, but enterprise and consumer networking companies led the way. The big cloud companies accounted for about 40% of data center revenue this quarter, so when you see companies like Oracle and club names Amazon, Microsoft, and Alphabet raising their capex outlooks, understand that a lot of that money is going to Nvidia. And, there’s a good reason for that. Nvidia Chief Financial Officer Colette Kress estimated on the conference call that for every $1 spent on Nvidia AI infrastructure, cloud providers have the opportunity to earn $5 in GPU instant hosting revenue within four years. One customer this quarter is Tesla, which is scaling its training AI cluster to 35,000 H100 GPUs (graphics processing units). Nvidia said Tesla’s use of Nvidia’s artificial intelligence infrastructure paves the way for “breakthrough performance” in Full Self-Driving Version 12. (Full Self-Driving, or FSD, is how Tesla markets its high-level driver assistance software. method. Another highlight is Meta’s announcement of its large-scale language model Llama 3, which is trained on a cluster of 24,000 H100 GPUs. Kress believes that as more consumer network customers use generative artificial intelligence applications. , Nvidia will see more growth opportunities. Tesla and Meta clusters are examples of what Nvidia calls “AI factories.” The company believes that “these next-generation data centers have advanced full-end accelerated computing platforms, data comes in, and wisdom comes out.” Nvidia also noted that sovereign AI has been a big source of growth. The company defines sovereign AI as “a nation’s ability to produce artificial intelligence using its own infrastructure, data, workforce, and commercial networks.” Even with the transition to Blackwell, Nvidia expects demand for Hopper to continue for quite some time With a full data center in place in the fourth quarter, the company said it has begun adding new products made specifically for the region that do not require export control licenses over concerns the U.S. government has restricted sales of its fastest chips. will be used by the Chinese military. However, it does not expect China to be a driver of revenue as it has been in the past, as the constraints of Nvidia’s technology make for a more competitive environment. For the current second quarter, Nvidia expects revenue of $28 billion, plus or minus 2%, higher than the market consensus of $26.6 billion in quarterly capital returns. That’s a 150% improvement, which is good, but the annual return is paltry for the investment case. The bigger impact is that the company repurchased $7.7 billion worth of stock in the fiscal first quarter (Jim Cramer). (Jim Cramer’s Charitable Trust Is Long on NVDA See here for a full list of stocks) As a subscriber to Jim Cramer’s CNBC Investing Club, you’ll be on the same page. Receive trade alerts before making a trade. Jim waits 45 minutes after a trade alert is sent before buying or selling a stock in his Charitable Trust portfolio. If Jim talks about a stock on CNBC TV, he will wait 45 minutes after a trade alert is sent. Wait 72 hours before executing a transaction. The above investment club information is subject to our Terms and Conditions and Privacy Policy and our Disclaimer No fiduciary duty or obligation is created or created by any information you receive in connection with the investment club. . No specific results or profits are guaranteed.

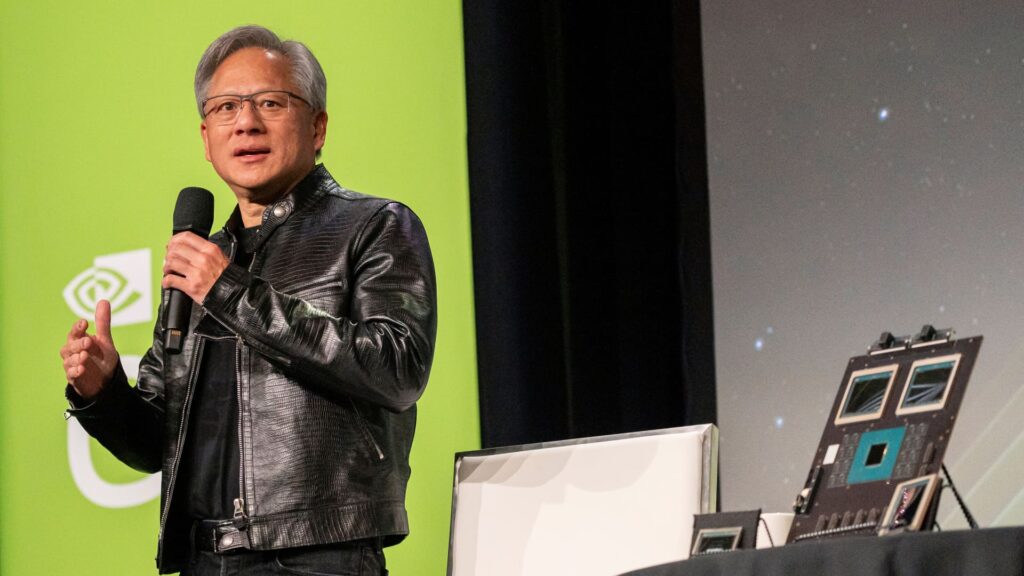

Nvidia Corporation co-founder and CEO Jensen Huang at the Nvidia GPU Technology Conference (GTC) in San Jose, California, USA, on Tuesday, March 19, 2024.

David Paul Morris | David Paul Morris Bloomberg | Getty Images

In the most anticipated quarter of this earnings season, Nvidia’s revenue and profits far exceeded high expectations. Even better was CEO Jen-Hsun Huang’s hefty revenue guidance and broader vision, which reinforced the idea that companies and countries are working with the AI chip giant to shift $1 trillion worth of traditional data centers toward accelerated computing.