miodrag ignjatovic/E+ via Getty Images

Omega Healthcare (NYSE: OHI) operating issues may have been factored into the REIT’s first-quarter consensus forecast, but dividend safety has become an issue.

OHI is scheduled to report first-quarter earnings results after the market close on Thursday, May 2.

Consensus FFO estimate of $0.65 (-1.95% Y/Y) Consensus revenue estimate is $199.91 million (up 8.00% year over year).

The real estate investment trust that owns skilled nursing and assisted living facilities reported fourth-quarter 2023 earnings and revenue that were down from the prior quarter but still better than expected as the operators remain in the restructuring process.

Chief executive Taylor Pickett said: “We expect earnings in the first and second quarters of 2024 to continue to be impacted by these restructuring efforts, although we expect earnings to improve as the year progresses and operator issues The company issued consensus 2024 AFFO guidance.

The first-quarter forecast appears to have factored in known operational issues. Sell-side analysts rate the stock a Buy, with an average price target of $32.92.

Wells Fargo recently upgraded its healthcare REIT as improving portfolio metrics drove higher rent coverage. Citi also upgraded OHI as the outlook for skilled nursing facilities continues to improve.

“As labor pressures ease and operators continue to effectively control costs, we expect occupancy and rental coverage to increase further. Tenant health issues are now less of a concern,” Citi said in a report.

However, dividend safety has become a concern.

Omega Healthcare’s dividend yield is no longer attractive compared to historical averages and risk-free rates. On top of that, according to Seeking Alpha writer Sensor Unlimited, dividend safety has become an issue due to dividend yields, earnings resistance and balance sheet conditions.

Omega Health Investors encountered tenant issues and a high payout ratio of over 100% in the most recent quarter, putting its dividend at risk. Its portfolio occupancy rates remain below pre-pandemic levels. SA writer The Dividend Collectuh says there are better dividend options in the healthcare sector.

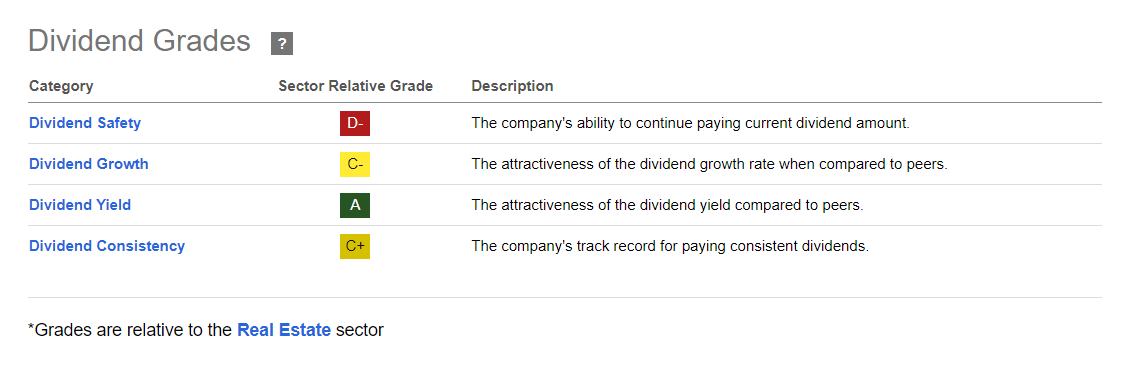

The company recently announced a quarterly dividend of $0.67 per share, giving it a forward yield of 8.97%. Here are OHI’s dividend grades: