Apple’s Pay Later feature is shutting down two years after its launch and less than a year after its launch in the United States, 9to5Mac reported on Monday. The Apple Pay feature allows users to take out loans and pay for purchases of $50 to $1,000 in four installments.

The report said the service, offered in partnership with Mastercard and Goldman Sachs, will be replaced by a built-in feature in the upcoming iOS 18 that allows third-party “buy now, pay later” lending companies such as Affirm to do the same.

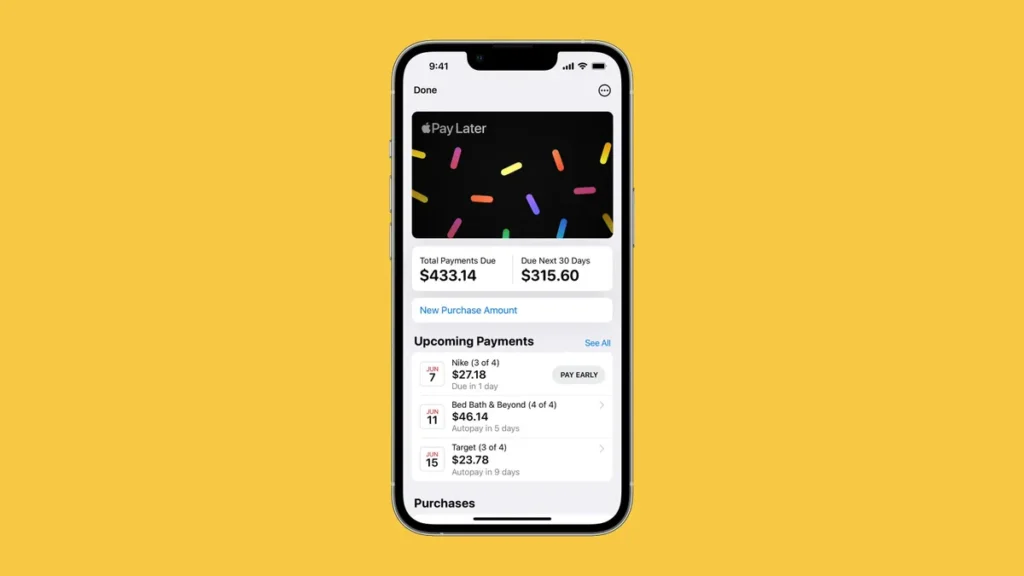

The appeal of Pay Later is that it offers loans with no fees or interest and can be tracked in Apple Wallet. Apple told the publication that users with existing Pay Later loans can still pay them off and track them through Wallet. Apple has only provided payment information since March, and only to Experian, not the other two credit bureaus.

Apple did not immediately respond to a request for comment, but told 9to5Mac in a statement on Monday that the change will happen later this year (iOS 18 will be released in September) and that loans will be available through credit, debit and credit cards .

“Our focus remains on providing our users with simple, secure and private payment options through Apple Pay, and this solution will allow us to work with Apple Pay to bring flexible payments to more users in more places around the world. banks and lenders,” Apple added.

Apple said in its WWDC announcement that in the United States, Citigroup, Synchrony Financial and Apple Pay issuers using Finserv software will be able to issue buy now, pay later loans through Apple Pay.

read more: Best Credit Cards of June 2024