In March, we looked at the differences between Home Equity Conversion Mortgages (HECMs) “expected interest rate” and “Watch the interest rates” And why most reverse mortgages depend on these two rates. In April, we paid particular attention to expected interest rates. We found that when expected interest rates rise and are rounded up to the next 1/8% (0.125%), the principal available to prospects typically decreases by an average of 0.6% (of the home’s value).

In the month since my last rate update, expected rates have increased by 39 basis points (0.39%), rounded to 3/8%, or three principal limit reductions. Unfortunately, these higher expected interest rates reduce the initial funding available to new HECM applicants.

But could higher interest rates offer a glimmer of hope? perhaps. When short-term interest rates rise, existing HECM customers will see their borrowing capacity increase at a faster rate. This brings us to the second rate, the ticket rate.

What is the bill interest rate?

Interest charges just accumulate. If payments are not made, the loan balance will increase.

So it’s understandable that rising interest rates may cause concern for many borrowers. However, month-to-month interest rate increases do not affect the reverse mortgage’s principal and interest payments; when the reverse mortgage is funded, these required monthly payments disappear.

So, what are the benefits of higher bill rates?

Homeowners with large loan balances generally want interest rates to go down, but borrowers who are willing and able to wait to withdraw their funds will benefit from higher rates. This is because the unused principal of a HECM adjustable-rate mortgage (ARM) will grow at the same rate as the loan balance.

For example, the line of credit (LOC) on a HECM loan balance with accrued interest of 7.50% (MIP of +0.50%) will grow at an annual rate of 8%, compounded monthly at 1/12 of that rate.

The same goes for any unused proceeds such as Life Expectancy Allowance (LESA). In fact, maintenance reserves and funds allocated for tenure and periodic payments will also benefit the borrower, providing greater borrowing capacity in the future.

example

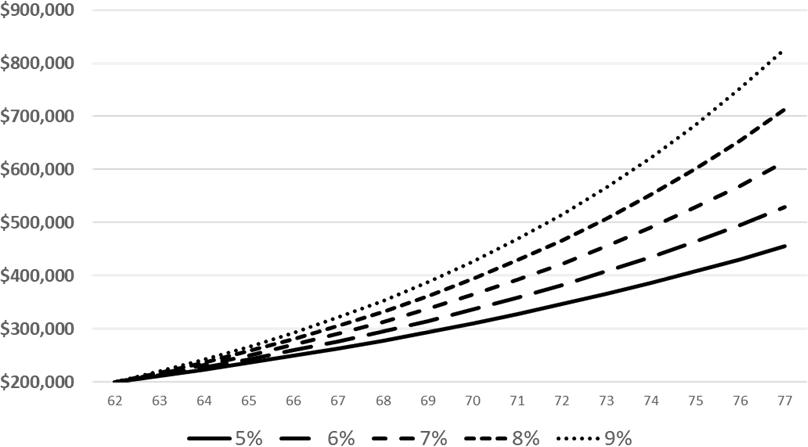

Consider “Harry the Homeowner”, 62, who has no existing mortgage. Harry hopes to use the HECM ARM credit line and its growth to meet future cash flow needs. Harry establishes an initial line of credit of $200,000. LOC and its growth can be modeled (below) to demonstrate the power of compound growth at different rates.

- Annotation rate 5%LOC will grow to $455,517.

- Annotation rate 9%LOC will grow to $826,919.

Updated May 2024

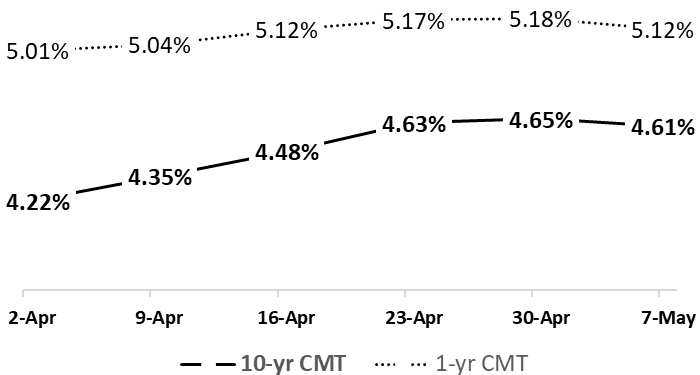

The 10-year CMT weekly average, used to calculate expected interest rates, rose 39 basis points from the previous month. However, the trend declined following last week’s jobs report.

The current weekly average of 4.61% is added to lenders’ deposits, effective for loans issued between May 7 and May 13.

This column does not necessarily reflect the views of daily reverse mortgage and its owners.

Contact the author of this article: Dan Hultquist at: [email protected]

To contact the editor responsible for this story: Chris Clow at: [email protected]