Nvidia’s star founder Jensen Huang backed Tesla’s artificial intelligence self-driving car strategy just weeks before a key vote that will determine whether Chief Executive Musk will receive a record pay.

Musk has all but bet the company on his recent shift toward artificial intelligence, quietly falling short of his vision to grow car sales more than tenfold to 20 million units a year by 2030 — the equivalent of a Toyota and Volkswagen sales combined.

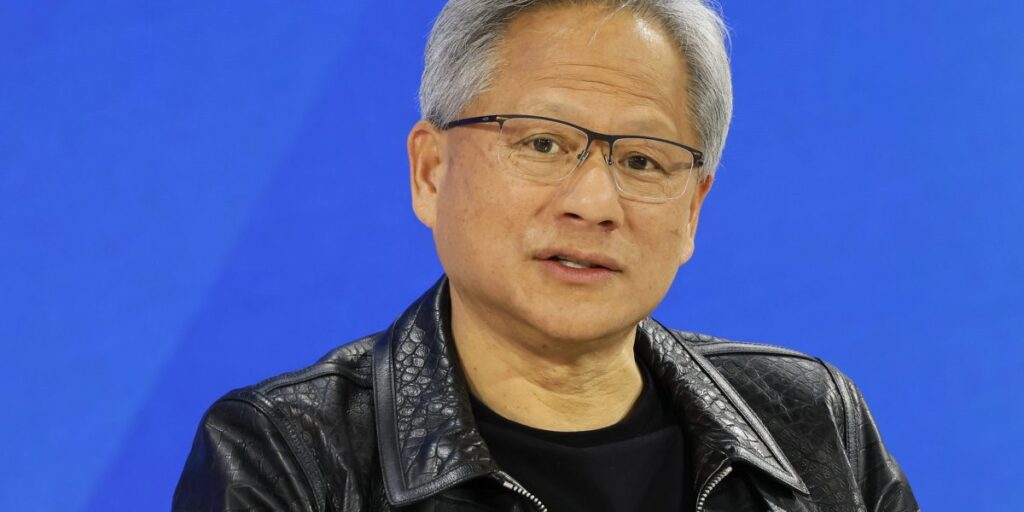

Huang confirmed in an interview: “Tesla is far ahead in self-driving cars” Yahoo Finance Uploaded to YouTube late last week.

The artificial intelligence focus is controversial because it takes Tesla away from its stated mission of accelerating the global transition to sustainable transportation. Although what Musk calls “supervised full self-driving” may be the best-known advanced driver assistance system (ADAS) on the market, few customers realize the value of spending $15,000 on a system that requires them to keep an eye on their car when it While trying to drive on city streets.

As a result, Musk was forced to lower the price to $8,000, which was the level when he first launched the FSD beta in October 2020.

High quality endorsement

The recognition from Huang and others may go a long way to allaying investor concerns that he himself may be off track.

“This technology is truly revolutionary and the work they’ve done is incredible,” the Nvidia boss continued.

What kind of rock concert is this? No, this is Jen-Hsun Huang’s keynote speech@nvidiaof #GTC24. Wow, what a difference a few years makes! pic.twitter.com/RqsiOg6Q2D

— Bob O’Donnell (@bobodtech) March 18, 2024

In a few weeks, shareholders will vote a second time on Musk’s record-breaking pay package – worth about $55 billion at current stock prices – after a Delaware court ruled in January against Tesla. Due to procedural reasons related to quality, the original vote in 2018 was declared invalid.

With proxy advisers like Glass Lewis now advising investors to vote against approving Musk’s pay, the outcome of the June 13 annual meeting is proving to be more stringent than expected.

A vote of confidence from someone like Huang in his new artificial intelligence strategy could improve his chances. Few businessmen are as respected as Jen-Hsun Huang, who founded Nvidia and has achieved exponential growth in recent years with his foresight to repurpose graphics processors to train artificial intelligence models such as OpenAI’s flagship product GPT-4o.

Musk and Tesla gobble up Nvidia AI chips at record pace

Huang praised the twelfth and latest version of Tesla’s Full Self-Driving (FSD) software, which abandons the previous method of hard-coding commands in computer language and instead relies entirely on artificial intelligence neural networks.

“It learns by watching videos,” Huang said. “This technology is very similar to large language model technology, but it only requires a huge training facility because of the data rate and data volume of video. so High.

Still, Huang also knows Tesla’s importance as a customer. Musk is a loyal customer of Nvidia’s artificial intelligence training chips, and its computing power in the first quarter alone more than doubled compared to the last three months of last year.

During this time, Tesla has spent a staggering $1 billion building out its artificial intelligence infrastructure, and that’s just the beginning. Tesla predicts that its computing power equivalent to 35,000 GPU clusters will reach 85,000 by the end of the year, by which time it may have spent $10 billion.

To afford that investment, Musk is willing to go to great lengths to cut costs elsewhere at a time when his core auto business needs to continue offering profit-eating incentives to prevent sales from falling.

He has laid off thousands of employees, laid off the team behind the industry-leading Supercharger network and scrapped plans to invest in a new assembly line for his upcoming $25,000 entry-level vehicle, now widely believed to be the Model 3 hatchback car.

But those sacrifices may not be in vain if it helps Tesla maintain its leadership in the electric vehicle industry and makes Musk $55 billion richer in the process.