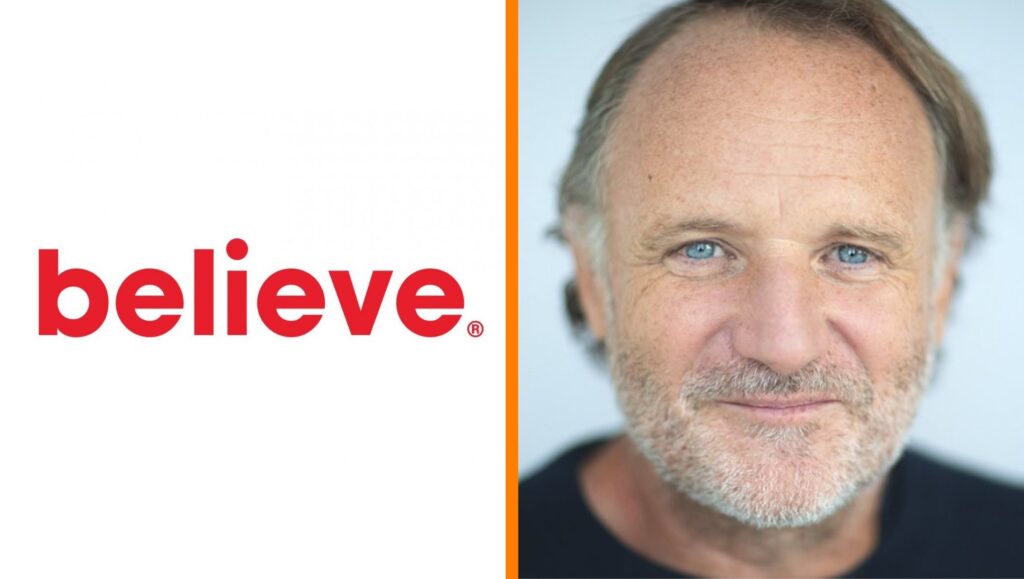

A consortium led by Believe founder and CEO Denis Ladegaillerie acquired more than 85% of the company in the takeover bid.

That fueled the consortium’s efforts to take Believe private.

In a market update on Friday (June 140), the consortium, optimistic bidding companyindicating that it has been obtained 85.04% Believe’s share capital and 73.27% Acquisition of its voting rights through agreement and simplified public offer.

The offer allows remaining shareholders to sell their shares at Euro 15 Euro ($16) per share until the end of this week (June 21). It also keeps Believe’s free float at 14.96% its issued share capital.

With more than 85% Controlling stake, Upbeat BidCo. It may force remaining shareholders to sell through a “squeeze-out” process at the end of the offer.

While the consortium, which also includes investment firms EQT and TCV, said they do not intend to pursue this option, the decision could have an impact on the remaining shares. because less than 15% The Believe shares will be publicly traded upon closing of the Offer and stock exchanges may elect to remove them from certain indices.

“The fact that the free float represents less than 15% of the capital stock should result in Believe’s shares being removed from certain stock market indexes in which Believe currently belongs.”

optimistic bidding company

The consortium said that “the fact that the free float represents less than 15% of the share capital should result in Believe’s shares being quickly removed from certain stock market indexes to which Believe currently belongs.”

France-based Believe has listed on Euronext Paris in 2021 after raising funds 300 million euros ($321 million). initially floating 14.35% Obtain its equity through an initial public offering (IPO).

The development has been the subject of a months-long saga that saw bids from a number of companies Warner Music Group fall. Warners considered making a Over 17 euros per share Offered to acquire Believe, but decided not to do so in April.

Ladegaillerie’s consortium made a takeover bid for Believe in February. the group’s 15 euros per share quotation representative twenty one% A premium to Believe’s February 9 closing price and bullish on the company 100% Pledge a1.523 billion euros ($1.63 billion).

Prior to Warner’s bid, Upbeat BidCo had acquired acquisition agreement 71.92% Existing shareholders’ beliefs: 59.46% from TCV Luxco BD S.à rl., Wentek and XAnge; and Radegehry’s 12.5% bet.

Believe is a digital music company that provides a range of services from distribution and promotion to technology and expertise to help artists grow their audiences and grow their careers.

Denis Ladegaillerie, founder, chairman and CEO of Believe, said in February: “Believe has a significant opportunity to consolidate the independent music market and create the first large-scale global independent music company for artists at all stages of their careers. Provide services.

“In achieving this goal, I am delighted to continue to benefit from the active support of TCV, which has been with Believe since 2014, and in partnership with Europe-based EQT, which has an excellent track record in supporting high-growth companies. Record.

global music business