Investors are weighing the possibility that a second Trump administration could stoke inflation by imposing higher tariffs, tightening immigration restrictions and extending 2017 tax cuts.

Held July 30-August at Inman Connect Las Vegas. On January 1, 2024, the noise and misinformation will be cut away, all your big questions will be answered, and new business opportunities will be revealed. join us.

Long-term interest rates surged on Monday as investors who fund most mortgages and government debt weighed the potential economic impact of rising tariffs, tighter immigration restrictions and an expected extension of 2017 tax cuts by the second Trump administration.

Mortgage rates have been trending lower from their 2024 highs in April, as a series of data releases showed inflation cooled in May.

Participate in the June INMAN Intel Index Survey

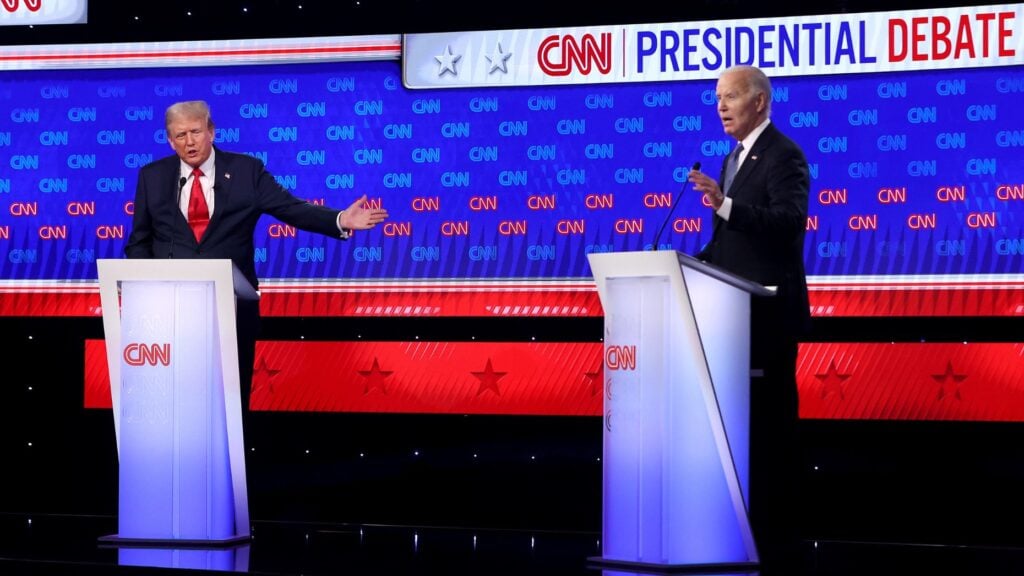

But President Joe Biden’s poor performance in polls after Thursday’s debate with Donald Trump has increased the likelihood of Trump regaining the White House.

A CBS News/YouGov poll released Sunday showed that 72% of registered voters believe Biden does not have the mental and cognitive health to serve as president, and 45% of registered Democrats believe he should abandon his campaign.

A Progressive Data poll found that 67% of voters believe Biden is too old to be president, but other candidates Democrats could field would perform similarly to Trump.

With Trump’s odds growing – and the prospect that Republicans could also regain control of the Senate – analysts at firms including Barclays, Goldman Sachs and Morgan Stanley are warning clients to hedge against inflation, Bloomberg News reported.

Analysts say Trump’s economic policies could reignite inflation and push up interest rates on long-term government bonds and similar investments like the mortgage-backed securities that fund most home loans.

For example, higher tariffs and a crackdown on immigration could increase inflationary pressures on prices and wages, while Trump’s pledge to make the 2017 tax cuts permanent could exacerbate the growing national deficit.

10-year Treasury yields soar

Source: Yahoo Finance.

The 10-year Treasury yield, a barometer of mortgage rates, surged 14 basis points on Monday to 4.48%. One basis point is equivalent to one hundredth of a percentage point, so a 24 basis point increase in the 10-year yield since June 25 is equivalent to about a quarter of a percentage point.

The 30-year fixed-rate mortgage rate rose 7 basis points on Monday to 7.14%, and has risen 11 basis points since June 25, according to interest rate data tracked by Mortgage News Daily.

Jack McIntyre, portfolio manager at Brandywine Global Investment Management, told Bloomberg that “bond vigilantes” appear to be selling government bonds in response to the fallout from the debate and the growing likelihood of a Republican sweep in November.

The bond market reacted similarly when Trump was elected in 2016, promising to cut taxes while boosting spending on infrastructure projects and increasing government borrowing.

While most of the $8.4 trillion in new borrowing Trump approved during his first term was pandemic-related, he also signed $4.8 trillion in non-COVID-19 debt, according to an analysis by the nonpartisan Committee for a Responsible Federal Budget. Biden approved $2.2 trillion in non-COVID debt in his first three years and five months in office.

The Tax Cuts and Jobs Act of 2017, which Trump has vowed to make permanent, is expected to add $1.9 trillion to government debt over 10 years, even if it expires next year.

Get Inman’s mortgage newsletter delivered straight to your inbox. A weekly digest of all the biggest news in mortgages and settlements around the world is published every Wednesday. Click here to subscribe.

Email Matt Carter