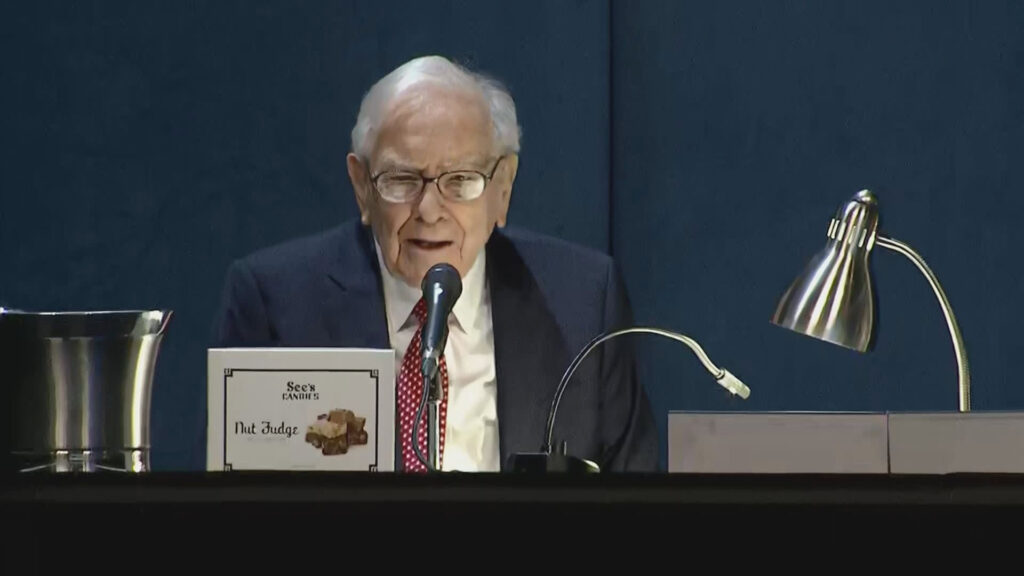

Berkshire Hathaway now holds more Treasuries than the Federal Reserve as Warren Buffett builds his cash fortress to record levels. The Omaha-based conglomerate held $234.6 billion in Treasury bill investments at the end of the second quarter, while it had more than $42 billion in cash and cash equivalents, including those with maturities of three months or less. of treasury bills. By comparison, as of July 31, the Fed held $195.3 billion in Treasury securities. The Fed has been a big buyer of government debt during the pandemic and has remained one of the largest holders of U.S. Treasuries as part of its efforts to maintain market liquidity. Buffett, 93, sold a slew of stocks including Apple last quarter ahead of a sharp decline in global stocks, a move that was surprising but also prescient. Berkshire Hathaway has been selling off stocks for seven consecutive quarters, but the pace of selling accelerated in the last period as Buffett dumped more than $75 billion in stocks in the second quarter. Many loyal Buffett watchers view the decision to sell off major holdings as a wake-up call that the Oracle of Omaha appears to have become pessimistic about the economy and markets. Buffett has noted in the past that in times of crisis, he would buy Treasury bills directly at auction. The government sells Treasury bills with maturities of four to 52 weeks. Buffett’s vast sum of money has been earning handsome returns thanks to a surge in U.S. Treasury yields over the past two years. If invested in three-month Treasury bills at about 5%, $200 billion in cash would generate about $10 billion per year, or $2.5 billion per quarter. The central bank bought about $5 trillion in Treasury and mortgage bonds to help the economy after the Covid-19 pandemic roiled markets. But the Fed has been reducing its asset holdings since June 2022, a program widely known as quantitative easing. The Federal Reserve seeks to promote maximum employment and price stability through the independent formulation of monetary policy. It involves buying and selling Treasury securities held by the public to control the money supply and interest rates.

Related Posts

Add A Comment