Daniel Balakov/E+ via Getty Images

Goldman Sachs managing director Scott Rubner said there will be inflows into some of the largest U.S. stock exchange-traded funds next week, and the stock market will hit a record high, which will trigger so-called “FOMU” among investors.

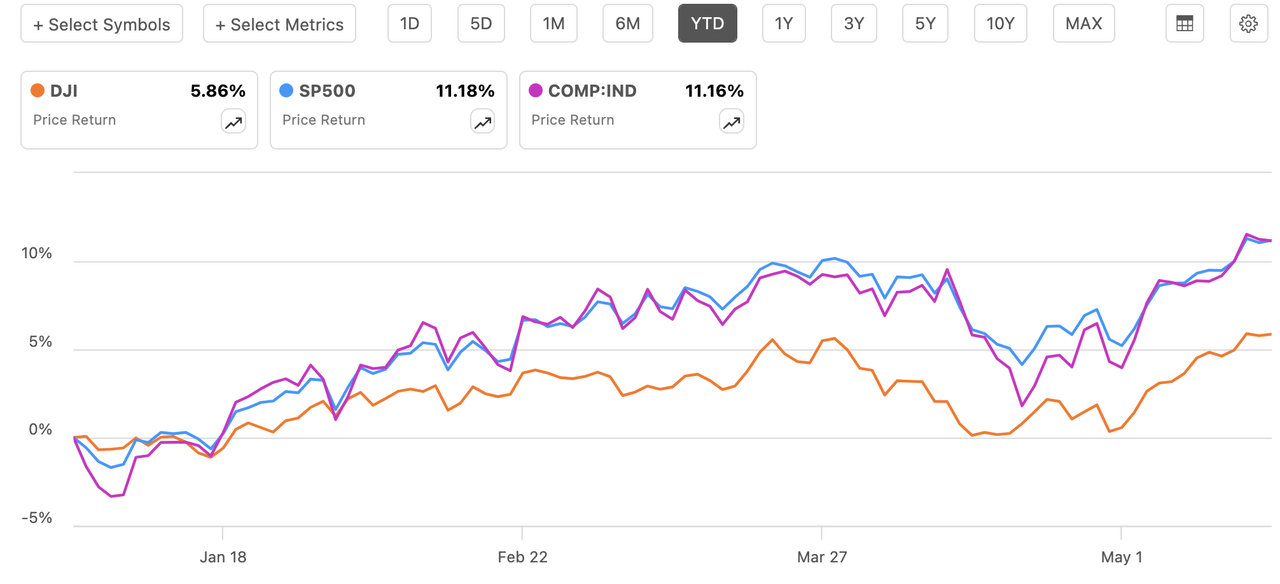

The Dow Jones Industrial Average (DJI) breaks through 40,000 and closes For the first time this week, the S&P closed at a record high (SP500)(flight) and the Nasdaq Index (Ingredients: IND). Stocks rose as inflation slowed in April, refreshing expectations for the Federal Reserve to cut interest rates this year.

“I started the conversation on FOMU with concerns about significant underperformance and the ‘US 60/40 Portfolio’ entering an active trading window this week,” Rubner said in a note on Friday. He noted, # DOW40K is a popular hashtag on social media.

Watch inflows from ETF giant SPDR S&P 500 ETF Trust (New York Stock Exchange: Spy) and the Invesco QQQ Trust ETF (QQQ) are set to follow record moves on Wall Street next week.

“Given the well-publicized ‘business as usual’ headlines here, it’s possible that a steady stream of retail traders will be adding ‘more 60/40 portfolios’ this weekend after checking trading statements,” Rubner said.

Rubner said the “stable retail base” of U.S. households owns 39% of the $78 trillion stock market’s cash holdings, 65% of which includes mutual funds and ETFs. “Traffic follows performance,” he said.

Bank of America said separately this week that weekly inflows into equity funds reached $11.9 billion, citing EPFR data. Money market outflows were $3.7 billion.

So far this year, the S&P 500 (SP500) and the Nasdaq (COMP:IND) are both up about 11%. The Dow Jones rose nearly 6%.

Here are some other equity ETFs on the market:

- iShares Core S&P 500 ETF (IVV) .

- Vanguard Total Stock Market ETF (VTI)

- iShares Russell 1000 Growth ETF (IWF)

- ProShares UltraShort S&P500 (SDS)

- Direxion Daily Semiconductor Bear 3 Stocks (SOXS)

Also, check out the Seeking Alpha Bonds page to see how Treasury yields behave across the curve.